- Moving the market

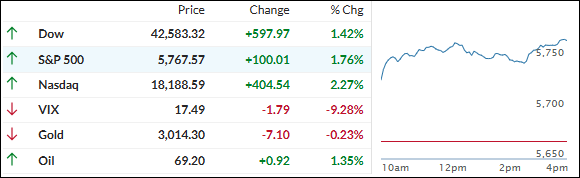

Equities surged after the opening bell as reports suggested that Trump might delay some of his broad tariff plans. Traders and algorithms quickly shifted to “Buy” mode, fueled by hopes that a global trade war could be averted.

Trump has indicated that tariffs target any country imposing duties on U.S. imports. However, the Wall Street Journal noted that the tariffs might be narrower in scope, focusing more on specific industries rather than broad impositions, with some nations potentially being excluded.

While Trump may show more flexibility in his approach, the situation remains fluid. For now, the effect on major indexes is positive and supportive. The markets also received a boost from Fed Chair Powell last week, who commented that any negative impacts from Trump’s tariffs would likely be short-lived.

Despite mixed results from the Services and Manufacturing PMIs, bond yields rose, and the indexes closed at their session highs, driven by an explosive short squeeze. Tesla, which had been struggling, managed a 12% comeback following reports that the FBI launched a task force to investigate the terror attacks.

Atlanta Fed President Bostic stated that inflation would be bumpy and not move dramatically towards its 2% target, which reduced expectations for rate cuts.

The dollar closed unchanged, gold slipped but found support at $3,000, and Bitcoin surged back above $88k to a three-week high.

Could this be the beginning of the next leg higher based on historical precedent?

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

Trump’s unexpectedly softer tone regarding upcoming tariffs boosted major indexes after the opening bell. Bullish momentum continued throughout the session, with the S&P 500 closing at intraday highs.

Our TTIs also recovered, with the Domestic TTI remaining slightly below its long-term trend line.

Once it crosses above this trend line, I will apply the same rules as when prices dipped below. This means I will wait a bit before adding to our domestic holdings to avoid a potential whipsaw signal, which is a “Buy” followed by a quick “Sell.”

This is how we closed 03/24/2025:

Domestic TTI: -0.08% below its M/A (prior close -1.13%)—Buy signal effective 11/21/2023.

International TTI: +5.57% above its M/A (prior close +4.96%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli