ETF Tracker StatSheet

You can view the latest version here.

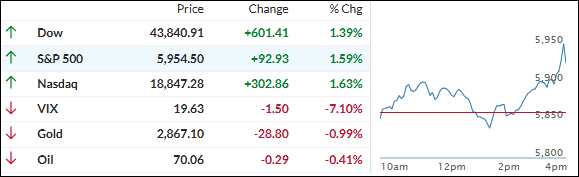

VOLATILE FEBRUARY ENDS WITH EQUITIES RECOVERING STRONGLY

- Moving the market

The major indexes advanced this morning as the much-anticipated PCE index, the Fed’s preferred inflation gauge, met expectations.

The data showed that inflation eased slightly in January, increasing by 0.3% for the month and 2.5% on an annual basis. The core PCE, which excludes food and energy prices, also rose by 0.3% for the month and 2.6% annually.

While this may keep the Fed in pause mode for now, inflation will need to soften considerably, or employment data will have to weaken before the Fed considers cutting rates again.

February, historically the weakest and most volatile period for stocks, has lived up to its reputation this year. Greater clarity on tariffs, inflation, and consumer health may help the markets recover.

Mid-session, the major indexes took a sharp dive into the red following news of a “testy” exchange between Trump and Zelensky during their meeting in Washington. However, traders were relieved as equities quickly recovered and closed solidly in the green, marking the end of a tumultuous February.

For the month, the Economic Surprise index declined, with most data points disappointing. The stagflation scenario—no growth and rising inflation—remains a concern.

Despite rising rate-cut expectations, the major indexes fell in February, led by Small Caps, with the S&P 500 losing 1.4% but barely remaining in the green year-to-date.

The Mag7 basket saw a dramatic $2.2 trillion drop in market cap from December highs, marking its second-largest monthly decline ever, as noted by ZH.

Bond yields, which rose in the first half of the month, reversed, and collapsed in the latter half. The dollar closed lower after an early spike, and Bitcoin’s downturn accelerated with increased ETF outflows, though it bounced strongly off its 200-day moving average today.

Gold emerged as the winner, maintaining gains despite selling pressure in the last week.

The seasonal composite indicates we are in a period of uncertainty, with trend direction potentially changing after March 13—if historical patterns hold true.

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

The final trading day of February was quite volatile, but ultimately, bullish sentiment won out. The major indexes closed firmly in the green, although they ended the month lower overall.

Our TTIs showed mixed results: the domestic TTI advanced, while the international TTI suffered a slight decline.

This is how we closed 02/28/2025:

Domestic TTI: +3.00% above its M/A (prior close +2.11%)—Buy signal effective 11/21/2023.

International TTI: +6.17% above its M/A (prior close +6.26%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli