- Moving the market

Oil prices dropped by over 4%, which helped equities rebound after yesterday’s losses. Despite ongoing tensions, Israel has yet to retaliate.

Bond yields rose slightly, but not enough to prevent a market recovery, with the Nasdaq leading the charge. The Middle East conflict, upcoming elections, hurricane damage, and other uncertainties are expected to increase market volatility.

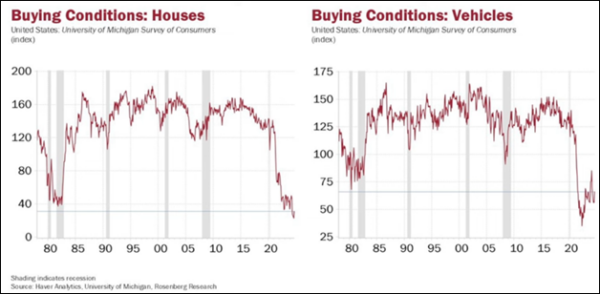

Traders remain optimistic about the economy’s resilience, even though many indicators suggest otherwise. For instance, buying conditions for houses and vehicles have plummeted to levels not seen since the 1980s, highlighting consumer struggles:

Given that consumer activity accounts for 67% of economic activity, such data does not indicate a robust economy.

The major indexes made a strong comeback, even as China’s markets fell overnight. The S&P 500 erased all of yesterday’s losses, and the MAG 7 stocks recovered but remained within their two-week trading range.

Bond yields paused their recent surge, ending mixed, with the 10-year yield closing at 4.021%, its highest since July. The dollar broke out of its three-day trading range but weakened towards the end of the session.

The dollar’s strength negatively impacted gold, which bounced off its $2.6k support level. Bitcoin also fell, giving up yesterday’s gains.

While the markets absorbed China’s mini-crash, upcoming events like the CPI report on Thursday and the start of the earnings season on Friday could disrupt positive trading sentiment.

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

Despite the market’s pullback yesterday, today’s sentiment shifted positively, leading to a robust rebound in the major indexes. This recovery occurred even though high bond yield levels persisted.

Interestingly, our TTIs showed a reversal in their performance: the domestic TTI gained, while the international TTI declined.

This is how we closed 10/08/2024:

Domestic TTI: +7.64% above its M/A (prior close +7.39%)—Buy signal effective 11/21/2023.

International TTI: +6.75% above its M/A (prior close +7.28%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli