- Moving the markets

The latest CPI report sent stocks higher and bond yields lower, as the index was unchanged for May vs. an expected 0.1% monthly rise. Year-over-year, the increase was 3.3%, which was also lower than the anticipated 3.4%.

Even the Fed’s favorite gauge, the core CPI, which excludes volatile components like energy and food, was in line with expectations. As a result, the 10-year yield dove some 14 bps to below 4.3% but gave some of it back late in the session.

As projected, the Fed kept interest rates unchanged, while indicating an improvement on the inflation front:

“In recent months, there has been modest further progress toward the Committee’s 2 percent inflation objective.”

However, these encouraging words were offset by remarks that the central bank only sees one rate cut taking place this year, which is quite a turnaround from the expected three at the beginning of 2024.

Here are some other clarifying comments, courtesy of ZH:

- POWELL: FED PROJECTIONS AREN’T A PLAN, THEY CAN ADJUST

- POWELL: WE ARE PRACTICING A SLIGHT ELEMENT OF CONSERVATISM ON OUR INFLATION OUTLOOK

- POWELL: WE’RE ASSUMING GOOD BUT NOT GREAT INFLATION NUMBERS

- POWELL: WE WELCOME TODAY’S INFLATION READING, HOPE FOR MORE

Rate-cut expectations soared after the CPI release, but Powell’s commentary pulled them back down to reality.

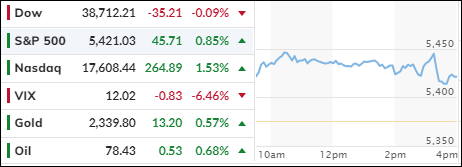

The major indexes followed a similar pattern, with the Dow not being able to maintain its upward momentum, as bond yields dropped sharply at first but rebounded into the close. The dollar ended the day lower but managed to cut its early losses late in the session.

Bitcoin rode the roller coaster and surrendered most of its early advances, with gold following suit but ending with modest gains. Crude oil pumped, dumped, and pumped again to assure a green close.

Hard data points are diverging from the S&P’s relentless move higher. Which way will this alligator snout snap shut?

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

While the CPI report was received as a positive, the Fed announcement was interpreted as somewhat hawkish. That caused some turmoil in the markets, with the Dow giving up all its early gains.

Our TTIs improved their bullish stance by a small percentage.

This is how we closed 06/12/2024:

Domestic TTI: +6.62% above its M/A (prior close +6.05%)—Buy signal effective 11/21/2023.

International TTI: +7.56% above its M/A (prior close +7.22%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli