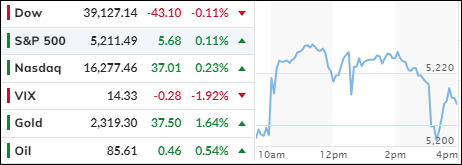

- Moving the markets

Stocks initially surged as Wall Street sought to recover from the early second-quarter slump.

However, by the end of the day, most gains had evaporated, leaving the major indexes struggling to maintain positive territory after an unexpected large-scale sell-off in the final hour.

Nvidia, a standout in artificial intelligence, saw its shares rise in Wednesday’s morning session, contributing to a more positive outlook across the market. Other tech giants, such as Netflix and Meta, also enjoyed gains of over 1%.

Despite this, the specter of higher interest rates continued to loom over the market, a trend that has persisted since the start of the quarter. The release of ADP’s data today, which showed a larger-than-anticipated increase in private payrolls for March, signaled economic resilience.

This comes amid growing investor anxiety regarding the Federal Reserve’s future interest rate decisions. Atlanta Fed President Raphael Bostic, in a statement to CNBC, projected only one rate cut this year, expected in the fourth quarter.

His comments echoed the sentiments of several Federal Reserve officials, including Chair Jerome Powell, who addressed the media and public across the nation today. Market predictions indicate a 94% chance that interest rates will hold steady at the Federal Reserve’s May meeting.

Expectations for a rate cut in June have decreased significantly, now standing at a 54.2% likelihood, down from 70.1% just a week prior.

The yield on the U.S. Treasury 10-year note reached a peak not seen since November, curbing stock market advances. Concurrently, oil prices hit their highest since October. Despite a challenging start to the quarter, some traders remain hopeful, suggesting that the market is poised for a period of stabilization rather than a steep decline.

Bond yields, which had been rising, settled unchanged by the close of trading. The dollar fell to a one-week low, which, coupled with higher bond yields, propelled gold to its fifth consecutive record close, nearly reaching the $2,300 mark.

As gold continues its ascent, one must wonder: What insights does the precious metal hold that remains elusive to traders?

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

The stock market experienced a brief uptick earlier in the day, but this momentum shifted as the day progressed, with the main indexes hovering close to their starting levels without significant change.

Despite the general market’s lack of movement, our TTIs defied the overall trend and achieved a slight increase.

This is how we closed 4/03/2024:

Domestic TTI: +10.76% above its M/A (prior close +10.62%)—Buy signal effective 11/21/2023.

International TTI: +10.19% above its M/A (prior close +9.88%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

—————————————————————-

Contact Ulli