- Moving the markets

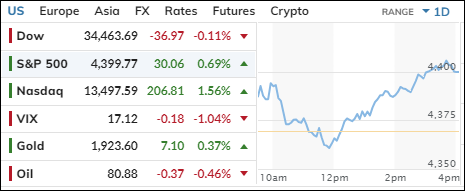

The tech sector finally got some relief, as the Nasdaq snapped a five-day losing streak and outperformed the other major indices. The S&P 500 also ended in the green, but the Dow barely budged.

The star of the show was Nvidia, which soared 8% ahead of its earnings report on Wednesday. The chipmaker received three more bullish upgrades, making its Boom/Bust chart look like this.

The tech rally was surprising, given that bond yields continued to climb to multi-year highs. The 10-year Treasury yield hit 4.34%, its highest level since November 2007, and closed there.

If the 10-year yield keeps rising, it could spell trouble for the stock market, as higher borrowing costs and lower valuations could dampen investor sentiment. The market already showed signs of weakness last week, when the S&P 500 and Nasdaq fell for a third consecutive week, and the Dow had its worst week since March.

Despite Monday’s bounce, I think the market is due for more correction. The bond market is offering attractive yields to investors who are skeptical about the earnings growth prospects of the S&P 500, which has been stagnant for about two years.

The dollar was flat, oil prices slipped but held above $80, and gold edged up +0.37%.

This week, all eyes will be on Federal Reserve Chair Jerome Powell, who will deliver a speech on Friday morning at the central bank’s annual symposium at Jackson Hole, Wyoming. Investors will be looking for clues about the Fed’s tapering plans and inflation outlook.

- “Buy” Cycle Suggestions

The current Buy cycle began on 12/1/2022, and I gave you some ETF tips based on my StatSheet back then. But if you joined me later, you might want to check out the latest StatSheet, which I update and post every Thursday at 6:30 pm PST.

You should also think about how much risk you can handle when picking your ETFs. If you are more cautious, you might want to go for the ones in the middle of the M-Index rankings. And if you don’t want to go all in, you can start with a 33% exposure and see how it goes.

We are in a crazy time, with the economy going downhill and some earnings taking a hit. That will eventually drag down stock prices too. So, in my advisor’s practice, we are looking for some value, growth and dividend ETFs that can weather the storm. And of course, gold is always a good friend.

Whatever you invest in, don’t forget to use a trailing sell stop of 8-12% to protect yourself from big losses.

- Trend Tracking Indexes (TTIs)

The stock market rebounded on Monday, but the recovery was not broad based. Tech stocks were the main drivers of the rally, while other sectors lagged.

This caused our Domestic TTI, which measures the direction and strength of the U.S. market trend, to stay in reverse mode and decline slightly. The International TTI, which tracks the global market trend, diverged, and rose a bit.

This is how we closed 08/21/2023:

Domestic TTI: +1.22% above its M/A (prior close +1.24%)—Buy signal effective 12/1/2022.

International TTI: +2.44% above its M/A (prior close +2.30%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli