ETF Tracker StatSheet

You can view the latest version here.

POWELL TALKS TOUGH ON INFLATION BUT MARKETS REMAIN OPTIMISTIC

- Moving the markets

Fed Chair Powell’s hawkish remarks at the Jackson Hole symposium did not deter the markets from rallying higher. Powell made it clear that he was ready to raise interest rates further if inflation and growth remained high. Here are some of his key points:

- He is watching for signs that the economy is not cooling as expected.

- He thinks inflation is still too high and needs more time to come down.

- He wants to see more evidence of improvement in non-housing services inflation.

- He says above-trend growth and a strong job market could justify more rate hikes.

- He plans to keep policy tight until he is confident that inflation is on a sustainable downward path.

However, traders seemed to ignore the implications of Powell’s words and bet that bond yields would not rise much. They also hoped that the Fed was close to ending its rate-hiking cycle. One analyst joked that the Fed’s message was: “We’ll hike again if we need to but won’t if we don’t.” That’s not very helpful.

Meanwhile, the data this week was mostly disappointing, according to ZeroHedge. The Citi Economic Surprise Index fell sharply, retail stocks suffered losses, and Nvidia’s stock plunged after a brief surge on earnings news.

On the other hand, bond yields were mixed, with the 2-year yield briefly topping 5%. The dollar had a volatile week but ended slightly higher. Gold rose above $1,900 and stayed there despite the post-Powell swings.

Even with the wild fluctuations, the AI Boom/Bust scenario is still on track, as this chart shows. We are approaching the moment of truth.

- “Buy” Cycle Suggestions

The current Buy cycle began on 12/1/2022, and I gave you some ETF tips based on my StatSheet back then. But if you joined me later, you might want to check out the latest StatSheet, which I update and post every Thursday at 6:30 pm PST.

You should also think about how much risk you can handle when picking your ETFs. If you are more cautious, you might want to go for the ones in the middle of the M-Index rankings. And if you don’t want to go all in, you can start with a 33% exposure and see how it goes.

We are in a crazy time, with the economy going downhill and some earnings taking a hit. That will eventually drag down stock prices too. So, in my advisor’s practice, we are looking for some value, growth and dividend ETFs that can weather the storm. And of course, gold is always a good friend.

Whatever you invest in, don’t forget to use a trailing sell stop of 8-12% to protect yourself from big losses.

- Trend Tracking Indexes (TTIs)

Traders ignored the Fed’s warning and boosted equities. Fed Chair Powell delivered some hawkish comments at the Jackson Hole symposium, signaling his readiness to raise interest rates if inflation and growth stayed high.

However, traders seemed to overlook the risks of higher bond yields and tighter monetary policy. They instead focused on the positive outlook for the economy and the stock market. As a result, equities rose higher, lifting our Domestic TTI from its slump and away from a possible “Sell” signal, at least for now.

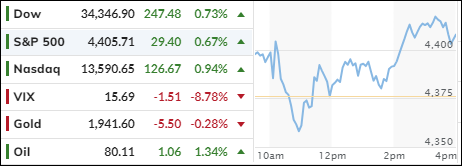

This is how we closed 08/25/2023:

Domestic TTI: +1.15% above its M/A (prior close +0.68%)—Buy signal effective 12/1/2022.

International TTI: +2.43% above its M/A (prior close +2.57%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli