- Moving the markets

The latest CPI report was a pleasant surprise for Wall Street, as US consumer prices rose less than expected in June. The core CPI, which excludes food and energy, increased by only 0.2% month-over-month, the smallest gain since February 2020.

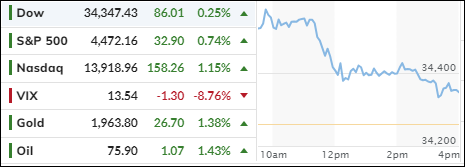

The annual inflation rate eased to 3.0%, the lowest since March 2021. This was music to the ears of traders and algos, who celebrated by lifting the S&P 500 to a new record intra-day high.

They were also encouraged by the fact that headline inflation has been slowing down for 12 consecutive months, suggesting that the worst of the inflation scare is over. But is it really?

Some analysts were not so optimistic, pointing out that the Fed still has to deal with some sticky sources of inflation, such as services, wages and housing. These components have moderated a bit, but they are still running too hot for comfort. That means the Fed will likely keep tightening its monetary policy, at least for now.

Traders, however, seem to think that the Fed is almost done raising rates, ignoring the fact that the cost of capital is now 5% higher than it was when the market was at similar levels and rates were near zero. Something doesn’t add up here.

Of course, no rally is complete without a good old-fashioned short squeeze, and today we had plenty of that. Interestingly, some of the biggest winners were unprofitable tech stocks, which surged 13% in four days, while the seven most valuable companies in the world barely budged. Go figure.

Bond yields also retreated, giving some relief to bond investors. The 2-year yield, which reflects the expectations of the Fed policy, fell almost 40 basis points from its recent high of over 5%. The dollar also took a beating and posted its biggest 4-day drop since April 2022. Gold shone brightly and climbed +1.38%.

Tomorrow we’ll get another inflation report, this time on producer prices. If it comes in lower than expected, it could fuel more optimism in the market. On the other hand, if we look at the huge divergence between the S&P 500 and high-yield corporate bonds, we might wonder if this party can last much longer.

- “Buy” Cycle Suggestions

The current Buy cycle began on 12/1/2022, and I gave you some ETF tips based on my StatSheet back then. But if you joined me later, you might want to check out the latest StatSheet, which I update and post every Thursday at 6:30 pm PST.

You should also think about how much risk you can handle when picking your ETFs. If you are more cautious, you might want to go for the ones in the middle of the M-Index rankings. And if you don’t want to go all in, you can start with a 33% exposure and see how it goes.

We are in a crazy time, with the economy going downhill and some earnings taking a hit. That will eventually drag down stock prices too. So, in my advisor’s practice, we are looking for some value, growth and dividend ETFs that can weather the storm. And of course, gold is always a good friend.

Whatever you invest in, don’t forget to use a trailing sell stop of 8-12% to protect yourself from big losses.

- Trend Tracking Indexes (TTIs)

The markets welcomed the lower-than-expected inflation report, as most stocks rose. The Dow, however, lagged the other two major indexes and gave up most of its early gains.

Our TTIs also reflected the bullish mood, with the Domestic one reaching a new high for this “Buy” cycle.

This is how we closed 07/12/2023:

Domestic TTI: +6.36% above its M/A (prior close +5.88%)—Buy signal effective 12/1/2022.

International TTI: +8.16% above its M/A (prior close +6.81%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli