ETF Tracker StatSheet

You can view the latest version here.

LIQUIDITY VS STOCKS: WHO WILL WIN?

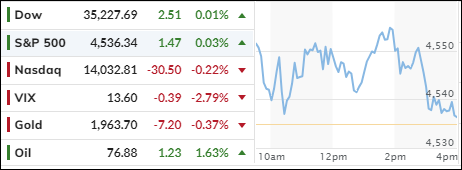

- Moving the markets

The stock market had a wild ride this week, as investors scrambled to adjust their portfolios before a major reshuffle of the Nasdaq-100 index on Monday. A flurry of options trading added to the volatility.

Corporate earnings were in the spotlight, but they failed to impress. Most of the companies in the S&P 500 beat the analysts’ low expectations, but not by much. The average beat rate was below the norm for the past three years.

Still, some analysts remained optimistic and predicted that the earnings were good enough to keep the market going up. They ignored the rising interest rates and the Fed’s tight monetary policy.

They also overlooked the weakening US economic data, which had its biggest weekly drop in more than two years. That could signal a recession, which usually means lower interest rates. But the Fed may not cut rates anytime soon, because it must protect the dollar from falling further and stoking inflation.

The market ended the week flat, after a short squeeze fizzled out. The squeeze had boosted some stocks earlier in the week, especially unprofitable tech stocks. But those stocks lost their shine by Friday, as did some of the tech giants like Tesla, Netflix and Nvidia.

Bond yields were mixed, the dollar had its best week since February, gold edged up and silver slid down.

Remember, liquidity is king in the market. Any divergence between liquidity and a stock index will eventually correct itself, as this chart shows.

Which way will it go? History says liquidity always wins.

- “Buy” Cycle Suggestions

The current Buy cycle began on 12/1/2022, and I gave you some ETF tips based on my StatSheet back then. But if you joined me later, you might want to check out the latest StatSheet, which I update and post every Thursday at 6:30 pm PST.

You should also think about how much risk you can handle when picking your ETFs. If you are more cautious, you might want to go for the ones in the middle of the M-Index rankings. And if you don’t want to go all in, you can start with a 33% exposure and see how it goes.

We are in a crazy time, with the economy going downhill and some earnings taking a hit. That will eventually drag down stock prices too. So, in my advisor’s practice, we are looking for some value, growth and dividend ETFs that can weather the storm. And of course, gold is always a good friend.

Whatever you invest in, don’t forget to use a trailing sell stop of 8-12% to protect yourself from big losses.

- Trend Tracking Indexes (TTIs)

The market was more volatile this week due to options contracts expiring, but our trend tracking indexes (TTIs) were not significantly affected. They only retreated slightly from their peaks on Wednesday.

This is how we closed 07/21/2023:

Domestic TTI: +6.74% above its M/A (prior close +7.02%)—Buy signal effective 12/1/2022.

International TTI: +8.14% above its M/A (prior close +8.98%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli