- Moving the markets

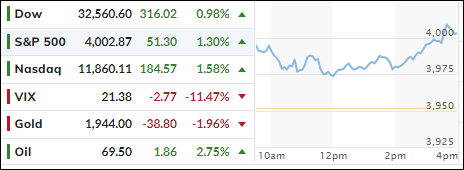

Optimism ruled today’s session following Treasury Secretary’s latest assertions to contain the banking crisis. That’s all traders and algos needed to hear and up went, with the S&P 500 now having wiped out this month’s losses.

Regional banks recovered, as the KRE index added 5.6%, helped by Yellen’s announcement that the government would be ready to provide guarantees of deposits, should the crisis worsen. Even the much beaten down First Republic Bank surged some 34% after having lost 47% the prior day.

Right now, nothing else matters other than the Fed meeting in progress, with their announcement on future interest rates to be announced around 11 am PST tomorrow. Traders are expecting a dovish 0.25% increase, with a pause not on deck at this time, but a hawkish 0.50% hike would be a shock to market participants.

Concluded Bloomberg:

The Fed needs to weigh the small credibility cost of not adhering to Powell’s recent guidance, against the potentially very large credibility cost of presiding over a bank sector-induced economic slump.

On the other hand, a significant dovish surprise might suggest that the Fed knows something very worrying that the markets don’t, and this signaling effect would be potentially just as risky as being too hawkish.

Uncertainty reigns and, as a result, bond yields moved higher and extended yesterday’s bounce-back, as the 2-year soared 24bps to solidly reclaim its 4% level.

Finally, the short-squeeze proved to have some legs but, as this chart indicates, it’s far from certain, based on the recent past, if this move will be followed by any duration.

Even though the US Dollar limped lower for the 4th day in a row, Gold was not able to capitalize and pulled back from its $2k level.

Again, nothing matters until Fed head Powell bestows his latest words of wisdom upon us.

2. “Buy” Cycle Suggestions

For the current Buy cycle, which started on 12/1/2022, I suggested you reference my then current StatSheet for ETF selections. However, if you came on board later, you may want to look at the most recent version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend for you to consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices. I can see this current Buy signal to be short lived, say to the end of the year, and would not be surprised if it ends at some point in January.

In my advisor practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

Our TTIs improved once more, as Yellen provided more assurances for endangered bank deposits. Our Domestic TTI has now moved to within striking distance of crossing its trend line to the upside again.

This is how we closed 03/21/2023:

Domestic TTI: -0.57% below its M/A (prior close -1.88%)—Buy signal effective 12/1/2022.

International TTI: +4.13% above its M/A (prior close +2.62%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli