ETF Tracker StatSheet

You can view the latest version here.

CRANKING AND TANKING AHEAD OF LABOR DAY

- Moving the markets

An early bounce, supported by an alleged “Goldilocks” jobs report, hit a brick wall, reversed, wiped out all gains, and pulled the major indexes into the red by over 1% with the Nasdaq posting a six-day losing streak, somethings it has not done since August of 2019.

August jobs came in with a gain of 315k, slightly above expectations of 298k, but lower than July’s downward revised number of 528k. As ZeroHedge reported, that was the lowest monthly increase since April 2021:

In other words, solid headline payrolls number, but weakness in the unemployment rate and another much needed tapering in wage growth. Still, it’s hard to see this report taking a 75-basis-point Fed hike off the table for Sept. 21. As such, the CPI report out on Sept. 13 will likely be the decider when it comes to 50 vs 75.

Then suddenly stocks got slammed on news that NO Russian gas will flow to Europe through Nordstream 1, after an oil leak was detected thereby keeping the crucial pipeline closed for an unspecified time to allow for repairs.

Ever since Powell’s Jackson Hole speech, the bulls have simply been pummeled with the Nasdaq taking an 8% hit—in only a week. All 10 S&P sectors ended the week in the red, which continues to support my view that during these tumultuous times, it’s best to stay on the sidelines and watch one disaster after another develop.

Bond yields ended about unchanged for the week, the US Dollar headed higher, and Gold managed a nice bounce off the $1,700 level.

With this week’s volatility, the analog to the events of 2008-2009 is still valid, as ZeroHedge posted. Again, if you are in the market without an exit strategy, you are asking for trouble.

Happy Labor Day weekend!

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

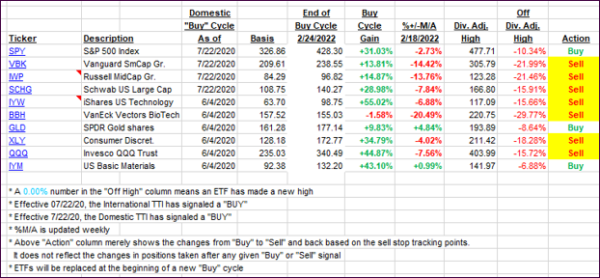

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this closed-out domestic “Buy” cycle (2/24/2022), here’s how some of our candidates have fared. Keep in mind that our Domestic Trend Tracking Index (TTI) signaled a “Sell” on that date, which overrode the existing “Buys” shown for SPY and IYM:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -12% point has been taken out in the “Off High” column, which has replaced the prior -8% to -10% limits.

3. Trend Tracking Indexes (TTIs)

Our Domestic TTIs took another hit and stormed deeper into bear market territory.

This is how we closed 09/02/2022:

Domestic TTI: -6.14% below its M/A (prior close -5.66%)—Sell signal effective 02/24/2022.

International TTI: -9.80% below its M/A (prior close -10.26%)—Sell signal effective 03/08/2022.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli