ETF Tracker StatSheet

You can view the latest version here.

FedEx WHACKS MARKETS

- Moving the markets

After yesterday’s thrashing, the markets continued to vacillate in red territory throughout the entire session, but the major indexes managed to rebound a bit to close off the lows for the day. Still, it was a week that most traders were relieved to see come to an end, as the losses were broad with the S&P 500 dropping 4.8%. Ouch!

Not helping matters was FedEx, after it withdrew its full-year guidance and said it will implement cost cutting initiatives, as the global economy has drastically worsened. The stock got clobbered and ended down some -24%. Transports tend to be the canary in the coalmine, so we can expect more negative announcements in that area.

The major indexes have now scored their fourth losing week out of five, which gives even more credence to the idea that any rebound is merely a dead-cat-bounce, as my indicators are confirming via their position below their respective trend lines (section 3).

Bond yields rose this week, the US Dollar surged, which meant Gold could not hold on to some of its gains, and the precious metal closed lower despite today’s bounce.

Added ZeroHedge:

In a scenario where the Fed has to keep pushing against growth until the unemployment rate reaches 5%, we see S&P 500 down-side to 3400.

And in a scenario where unemployment hits 6%, the S&P 500 may dip below 2900. In other words, there may be a lot more downside to markets if stagflation persists.

Updating and extending the financial crises analog to 2008-2009, this picture is worth a thousand words.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

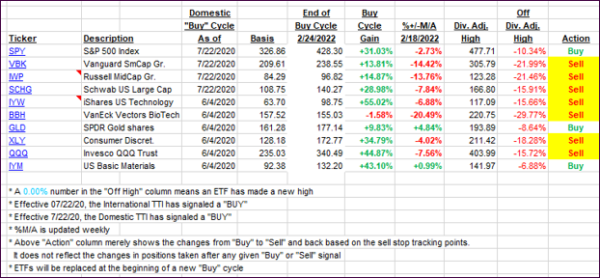

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this closed-out domestic “Buy” cycle (2/24/2022), here’s how some of our candidates have fared. Keep in mind that our Domestic Trend Tracking Index (TTI) signaled a “Sell” on that date, which overrode the existing “Buys” shown for SPY and IYM:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -12% point has been taken out in the “Off High” column, which has replaced the prior -8% to -10% limits.

3. Trend Tracking Indexes (TTIs)

Our TTIs dropped further, as the bearish beat continued.

This is how we closed 09/16/2022:

Domestic TTI: -6.43% below its M/A (prior close -5.76%)—Sell signal effective 02/24/2022.

International TTI: -10.43% below its M/A (prior close -9.84%)—Sell signal effective 03/08/2022.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli