ETF Tracker StatSheet

You can view the latest version here.

LIMPING INTO THE WEEKEND

- Moving the markets

In a similar fashion to yesterday, the markets chopped around with the Dow again being the weakling, while the S&P clung to its unchanged line, but the Nasdaq continued its ascent to higher prices and gained 0.40%.

With a solid earnings season coming to an end, it’s understandable that a slowdown is in order, that is until a new driver appears to propel the indexes towards their much hoped-for year-end rally. Right now, we’re in a lull, which is influenced by refreshed Covid concerns, the reminder that inflation will be anything but “transitory,” and the potential of Fed tightening.

Not helping the bulls over the past few days was the absence of the always welcome short squeeze, as most shorted stocks did what they do best, when not manipulated, namely drop in price.

Bond yields operated in a world of their own with the 2-year spiking and the 30-year sinking, which paints a picture of uncertainty in that arena. This can easily influence the equity market, should conditions become more extreme.

The US Dollar index rode the roller coaster yet, despite losing some mojo in the end, closed higher by 0.51%. Dollar strength, and recovery fears, sent commodities (DBC) lower for this week, as ZeroHege noted.

Despite today’s 0.69% pullback, gold managed to hang on to its $1,800 level, but showed a strange top like pattern this week.

ZeroHege pointed to some good news for the lowly consumer in that gas prices at the pump are offering some relief, if this chart is any indication. The only question is: How long will this last?

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

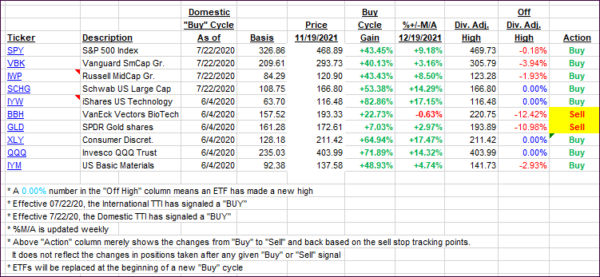

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs retreated, because of more weakness in the broad market. The International TTI is heading towards a potential break through its trendline and into bear market territory. But we are not there yet.

This is how we closed 11/19/2021:

Domestic TTI: +6.24% above its M/A (prior close +7.41%)—Buy signal effective 07/22/2020.

International TTI: +1.69% above its M/A (prior close +2.87%)—Buy signal effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

Contact Ulli