ETF Tracker StatSheet

You can view the latest version here.

STORMING INTO JULY

- Moving the markets

After the month of June successfully did not validate the adage held my many investors “sell in May and go away,” the major indexes gathered steam and stormed into July setting more records in the process.

On deck today was the jobs report with the headline number showing that 850k of new positions were added during last month. That was better than the expected 706k and ousted the disappointing 559k number from May.

Looking under the hood, it turns out that more than 50% of all job gains were bartenders and teachers, which collectively added 463k seasonally adjusted jobs, as ZeroHedge pointed out.

Traders did not care but simply interpreted this number as an accelerating recovery for the labor market and pushed the S&P 500 to a new all-time high. The tech sector contributed with Apple and Salesforce adding over 1%.

A strategist at Edward Jones saw it this way:

I think it was one of these goldilocks-type of reports, because hiring accelerated — which is a positive sign for the second half and the recovery — but not so much that it would trigger a reaction of an accelerated timeline for the Federal Reserve to start tapering.

In the end, the markets liked today’s numbers, and the bulls were clearly in charge assuming this “not too hot and not too cold” report will not create an environment that could cause the Fed to take away the liquidity punch bowl, as ZH called it.

As a result, the S&P 500 rose for a seventh consecutive day, which was its longest winning streak since last August.

Bond yields continued to drift with the 10-year bouncing off its lows and ending up at 1.437%. The US Dollar Index took a dive, thereby giving Gold a much overdue assist with the precious metal gaining +0.65% but not being able to recover its $1,800 level.

Right now, the bulls are dominating, but for some reason the “smart money” is not participating.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

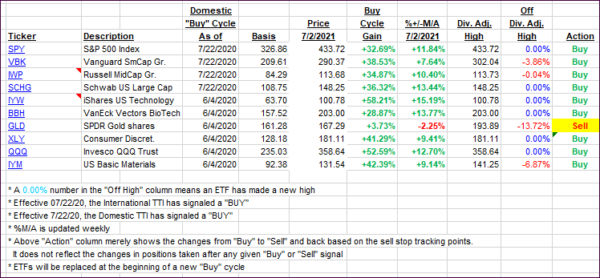

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs slipped despite the market’s bullish tones.

This is how we closed 07/2/2021:

Domestic TTI: +13.38% above its M/A (prior close +14.01%)—Buy signal effective 07/22/2020.

International TTI: +10.33% above its M/A (prior close +10.80%)—Buy signals effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli