- Moving the markets

The futures markets jumped out of the gate, as Trump presented an upbeat outlook during Sunday evening’s press conference with officials in New York and Italy reporting notable declines in new cases and deaths:

“We are beginning to see the glimmers of progress,” Pence said at a White House news conference on Sunday. “The experts will tell me not to jump to any conclusions, and I’m not, but like your president I’m an optimistic person and I’m hopeful.”

It’s impossible to tell which news headline valid and which ones are hype, but the computer algos simply ran with it and pumped the major indexes to solid gains with the Dow adding some 1,600 points for the day.

On other hand, the virus news what not that great with one analyst commenting:

“The virus is continuing to spread unchecked, especially in the US. US President Trump has warned that the population should prepare itself for two very tough weeks. This will further delay any normalization of public life. The economic impact is already very serious.”

Of course, whenever markets make a huge rebound move as we saw today, there’s bound to be a short squeeze involved. And indeed, ZeroHedge identified it as the second-biggest short-squeeze ever.

Additionally, a $6.5 billion MOC (Market On Close) order propelled the indexes into the close in a simply mind-numbing melt up. Given the bullish response, you would have expected gold to take a dive and tank, but we’re not living in ordinary times. Things are so twisted and non-sensical that gold soared to 8-year highs (above $1,700) totally in sync with the direction of equities. Huh?

Even JP Morgan seemed to have some doubts and suggested that “investors should prepare for a coronavirus-induced ‘vicious’ spiral more than twice as bad as the financial crisis.”

It’s impossible to say how this plays out, although I am personally more aligned with JP Morgan’s statement. However, right now, at least for this day, the buy-and-hold crowd has something to cheer about by having reduced some of their steep losses.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

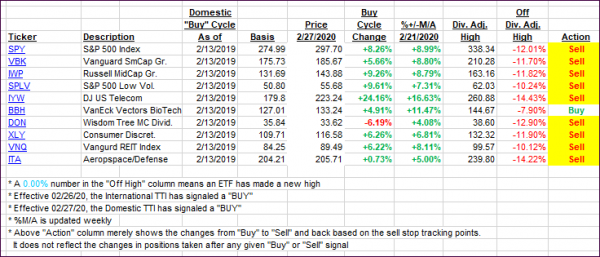

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this past domestic “Buy” cycle, which ended on 2/27/2020, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

In my advisor practice, we may or may not be invested in some of the 10 ETFs listed above.

3. Trend Tracking Indexes (TTIs)

Our TTIs rallied sharply as the markets melted up today, but we remain stuck on the bearish side of our respective trend lines.

Here’s how we closed 04/06/2020:

Domestic TTI: -19.27% below its M/A (prior close -24.95%)—Sell signal effective 02/27/2020

International TTI: -18.22% below its M/A (prior close -22.02%)—Sell signal effective 02/26/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli