ETF Tracker StatSheet

You can view the latest version here.

CLOSING A MEDIOCRE WEEK ON AN UPSWING

- Moving the markets

At least for the S&P 500 and Nasdaq, today’s session was another one of the see-saw variety, while the Dow managed to hover on the plus side the entire day.

An early pop followed by a drop set the early tone with Trump issuing what some traders considered a “buy” signal by merely repeating the good old standby phrase, namely that “a deal with China is close.”

This was followed a threat when he “warned XI not to send soldiers to Hong Kong.” But he made good on any fallout from his remark by pronouncing the he “declines to say if he’ll sign Hon Kong bill.”

ZH charted these market moving effects, which simply demonstrates that the computer algos reacted exactly as expected.

Of course, the ongoing trade soap opera would not be complete without China’s Xi joining the fray and chiming in with things like “Beijing wants to work for a trade deal with the U.S. but is not afraid to ‘fight back,’” and that he holds a “positive attitude” towards the talks, but that a deal requires “mutual respect and equality.”

So, the jawboning goes on without any concrete progress being made. Surprisingly, the markets reacted positive with the indexes scoring a green close for the first time in four trading days. However, the setback for the week was minor -0.32% for the S&P 500—hardly a correction worth mentioning.

However, ZH pointed to this chart showing that the real reason or this week’s “pullback” was simply the unexpected contraction of the Fed’s balance sheet (Source: Bloomberg). Hard to argue with the conclusion.

The markets have been very turbulent over the past 2 years and many readers have emailed me to clarify a variety of questions about the ever-changing investment environment. A good way to enhance your understanding is this U-tube video, during which host Greg Hunter goes one on one with author and analysist John Rubino. It’s 30 minutes well spent.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

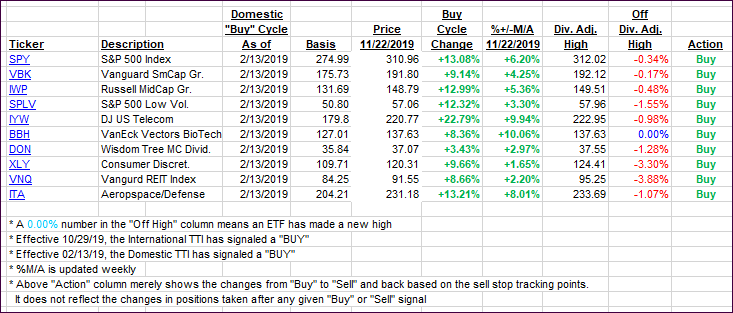

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) went opposite directions but moved only trivially.

Here’s how we closed 11/22/2019:

Domestic TTI: +5.34% above its M/A (prior close +5.26%)—Buy signal effective 02/13/2019

International TTI: +3.52% above its M/A (prior close +3.35%)—Buy signal effective 10/29/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli