- Moving the markets

Two forces combined to pull the markets out of the doldrums after Monday’s drubbing. For one, we saw corporate buybacks pick up speed, and two, a giant short-squeeze, now its third day, threw an assist to push the S&P 500 slightly above last Friday’s close. Both, the Nasdaq and S&P are back in the black for the week.

Setting the stage early on, was China’s Yuan, the peg of which is still set at the weakest level since 2008 but slightly higher than feared. That helped steady markets worldwide, as global growth fears subsided a tad and allowed the Global Dow to finally show a gain after the recent spanking.

While the markets seem to have stabilized for the time being, traders are still uneasy, as it would not take much to turn this trend around and retest Monday’s lows. Soothing the mood on Wall Street, however, was the volatility index (VIX), which dropped back from its recent highs to settle at a not so nerve-wrecking 16 level.

In the end, for us trend followers, no damage was done, and the major trend direction remains bullish, keeping us on board until that fact materially changes.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

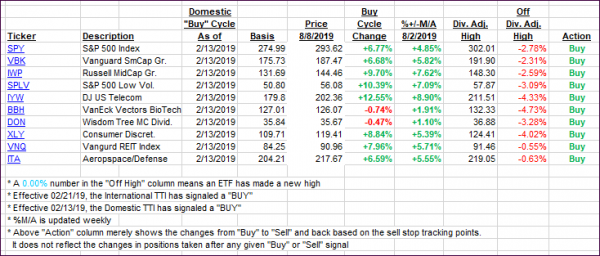

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) surged with the International one now having crawled back above its long-term trend line, thereby keeping the current ‘Buy’ signal alive.

Here’s how we closed 08/08/2019:

Domestic TTI: +4.30% above its M/A (prior close +2.46%)—Buy signal effective 02/13/2019

International TTI: +0.58% above its M/A (prior close -0.86%)—Buy signal effective 06/19/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli