1. Moving the markets

One of the most eagerly watched events, namely the Fed’s verdict on interest rates, came and went without much of a market hiccup. A gentle early slide gave way to a modest bounce late in the session, with the major indexes notching another green close and moving within striking distance of taking out their old all-time highs.

The Fed decided to hold interest rates steady and motioned that it’s unlikely that they would cut borrowing costs for the remainder of the year. Of course, judging by their past actions, nothing is ever chiseled in stone, and they left themselves a little wiggle room by pronouncing to “closely monitor” inflation and growing “uncertainties.” The latter appeared to be a jab at the escalating trade tensions between the U.S. and China.

In other words, if things change, they may change their mind…

While the White House might not be too pleased with this outcome (Trump has been advocating an interest-rate cut for months), market reaction was kind of muted, but we did zig-zag higher after the Fed announcement.

Bond yields were the beneficiary, as yields dropped with the 10-year heading towards the 2.01 level, while the U.S. Dollar tumbled after the Fed released its statement.

Could the markets take off from here and push into record territory? For sure, “if” at the upcoming G-20 meeting in Japan, Trump and his Chinese counterpart Xi agree to a trade deal, or at least pronounce progress in negotiations. That should do the trick and give a boost to the major indexes.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

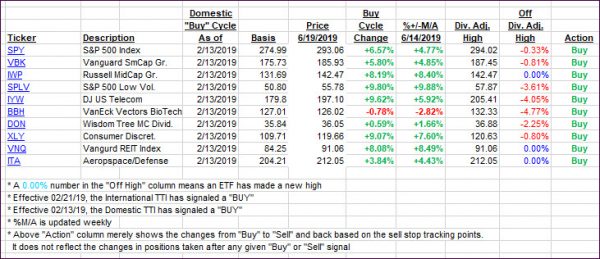

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) edged higher and are now solidly positioned on the bullish side of their respective trend lines.

Here’s how we closed 06/19/2019:

Domestic TTI: +5.80% above its M/A (last close +5.42%)—Buy signal effective 02/13/2019

International TTI: +3.33% above its M/A (last close +2.66%)—Buy signal effective 06/19/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli