- Moving the markets

Investors were all over the released March Fed minutes trying to gain some insight as to why the Fed decided to give up on normalizing their monetary policy. Recall that last month the Fed abandoned plans for further rate increases in 2019 due to uncertainty over the lack of growth not just in the U.S. but global economies as well.

Other worries listed were the U.K.’s struggle to leave the EU, ongoing trade tensions between the U.S. and China and allegedly unexpected tame inflation data. In the end, there appeared to be too many unknowns causing the committee to leave interest rates unchanged.

But today, we learned that consumer prices rose at the fastest pace in 14 months in March but, with the following line always used as the saving grace, gains were small when excluding volatile food and energy prices.

The European Central Bank (ECB) seemed to use the same playbook, as they announced no changes to monetary policy and confirmed its intention of leaving rates at current levels till the end of 2019.

The markets took it all in stride with the major indexes remaining mostly above their unchanged lines with the S&P 500 and Nasdaq seeing more buying at the end of the session than the Dow, which barely slipped into the green.

Helping the last hour push was a short squeeze, the biggest since February 27th, while interest rates fell with the 10-year yield now back below the 2.5% level causing the U.S. Dollar index to drop to its lows of the session.

Our Trend Tracking Indexes (TTIs) benefited from the last hour ramp keeping our “Buy” signals intact.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

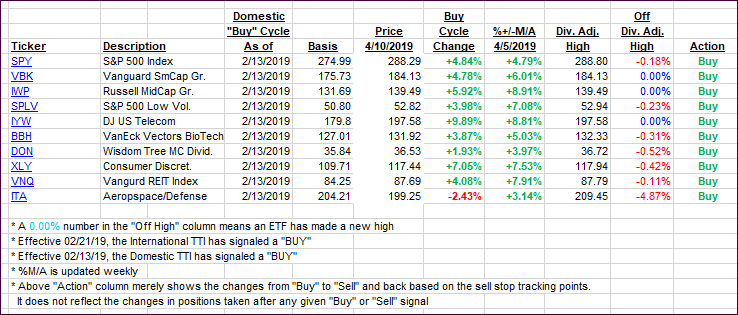

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed north, as today’s session favored the bullish theme.

Here’s how we closed 04/10/2019:

Domestic TTI: +5.77% above its M/A (last close +5.25%)—Buy signal effective 02/13/2019

International TTI: +3.43% above its M/A (last close +3.33%)—Buy signal effective 02/21/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli