ETF Tracker StatSheet

ENDING THE WEEK WITH SOLID GAINS

[Chart courtesy of MarketWatch.com]- Moving the markets

Despite this being a Holiday shortened week, the major indexes managed to eke out some solid gains supported by a better than expected jobs report, as the economy created 213k new jobs in June. That was better than the hoped for 200k number. Also, the readings for May and April were revised higher.

Imagine these numbers being an overriding factor in market direction when considering that the gauntlet has been thrown, as this Friday marked day 1 when the “largest scale trade war in economic history” was launched. Duties on $34 billion in tariffs of Chines exports started at 12:01 AM this morning.

Quipped Zero Hedge:

If Small Caps are up 3% in a week when Trump unleashes $34 billion in tariffs on China, imagine how much it will be up when he brings the full weight of his planned $500 billion tariffs…

Things are clearly out of whack, as bond yields are disconnected from the level of stocks, as this chart shows. It brings up the usual question: Will bond yields rise to meet S&P levels, or will it be the other way around? Just remember, when it comes to economic reality, bonds are way ahead of stocks.

As I said earlier in the week, these 4 trading days may cause some volatility with most traders being out for the Holiday. We should see on Monday whether this rally has legs or was simply a result of low volume trading when markets can be easier manipulated.

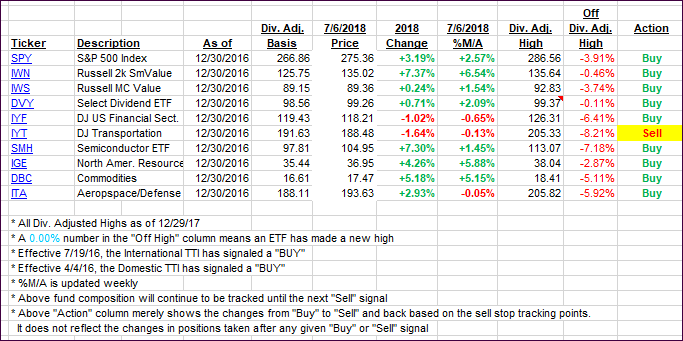

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) rallied with the International one having done a complete reversal this week. Let’s see if there is enough upward momentum left to generate a new “Buy” signal, or if this was just a dead cat bounce.

Here’s how we closed 07/06/2018:

Domestic TTI: +2.09% above its M/A (last close +1.78%)—Buy signal effective 4/4/2016

International TTI: -0.23% below its M/A (last close -0.93%)—Sell signal effective 6/28/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & As

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli