- Moving the markets

A host of news events combined forces to pull equities off their lofty levels with the S&P 500 having its worst day in 5 months, while bonds had their worst day in 6 weeks. First, there were the NAFTA negotiations, which appeared to be progressing well, but the fly in the ointment was that there was no willingness to issue a joint statement thereby putting pressure on the stock market early on.

The VIX spiked and did not pull back and, with the market manipulators apparently asleep at the wheel, closed at its highest since August. Then rising interest rates kicked in with the 10-year bond yield jumping 4 basis points to close at 2.70% (intra-day to 2.72%) its highest level since April 2014. A variety of individual stocks took a noticeable dive such as WYNN (Steve Wynn sex scandal), AAPL (iPhone X orders slashed) and CAT (declining margins), all of which gave the bears the upper hand—at least for this day.

However, in the bigger scheme of things today’s pullback is hardly worth mentioning when considering the rapid market advances we’ve seen not only last year but during the first month of this year as well. With all this debacle going on, the US Dollar (UUP) managed to buck the overall negative trend by closing up +0.26%; a tiny bounce off its multi-year lows.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

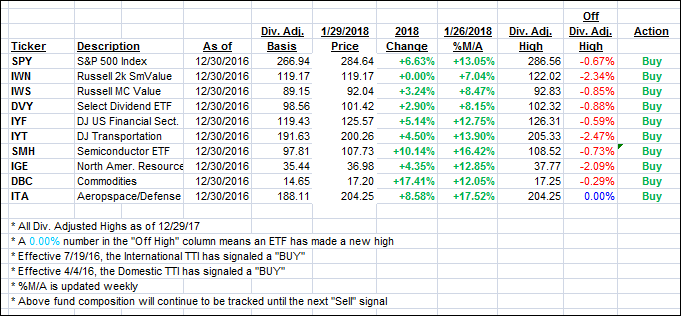

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) came off their all-time highs as the major indexes ended in the red.

Here’s how we closed 1/29/2018:

Domestic TTI: +5.09% above its M/A (last close +5.40%)—Buy signal effective 4/4/2016

International TTI: +9.09% above its M/A (last close +9.70%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli