Authored by MN Gordon via EconomicPrism.com,

“Inflation is always and everywhere a monetary phenomenon,” once remarked economist and Nobel Prize recipient Milton Friedman. He likely meant that inflation is the more rapid increase in the supply of money relative to the output of goods and services which money is traded for.

As more and more money is issued relative to the output of goods and services in an economy, the money’s watered down and loses value.

By this account, price inflation is not in itself rising prices. Rather, it’s the loss of purchasing power resulting from an inflating money supply.

Indeed, Friedman offered a shrewd insight. However, he also accompanied it with an opportunist mindset. Friedman saw promise in the phenomenon of monetary inflation. Moreover, he saw it as a means to improve human productivity and economic growth.

You see, a stable money supply was not good enough for Friedman. He advocated for moderate levels of monetary growth, and inflation, to perpetually stimulate the economy. By hardwiring consumers with the expectation of higher prices, policy makers could compel a relentless consumer demand.

This desire to harness and control the inflation phenomenon has infected practically every government economist’s brain since the early 1970s.

Over the decades they’ve somehow come to a consensus that 2 percent price inflation is the idyllic rate for provoking economic nirvana. The Fed even tinkers with its federal funds rate for the purpose of targeting this magic 2 percent rate of price inflation.

Shadow Stats

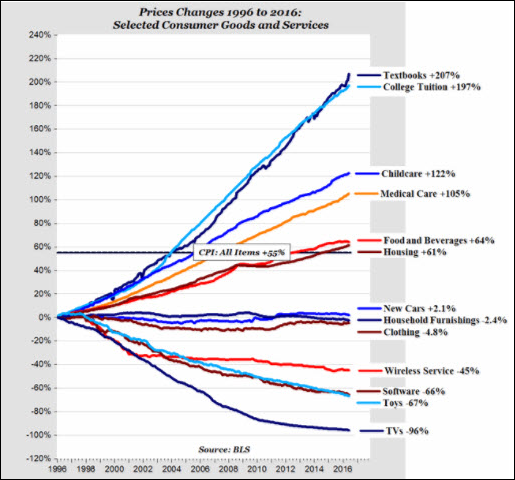

On Wednesday the Bureau of Labor Statistics (BLS) published its October Consumer Price Index (CPI) report. According to the government number crunchers, consumer prices are increasing at an annual rate of 2 percent. Of course, anyone who lives and works in the real world knows prices are rising much faster.

For example, John Williams of Shadow Government Statistics calculates the CPI using early-1980s methods. Williams re-creates how the government previously calculated the CPI before they reconfigured their scheme to understate inflation versus common experience. By Williams’ calculations the CPI is increasing at an annual rate of 9.8 percent.

What price inflation number you believe is up to you. We’re merely providing information for your consideration. Are consumer prices rising at 9.8 percent per years, as Williams suggests? Are they rising at 5 percent? Are they going down?

We suppose it depends on if you’re buying a flannel shirt at Wal-Mart or paying your utility bill. Still, many would agree that, overall, their day to day experience includes price increases far greater than 2 percent per year.

If we assume price inflation to be 3 percent per year, that means the purchasing power of your cash drops by 30 percent over a 12 year period.

Hence, if you retire at age 62, that means you’ll see the purchasing power of each dollar you own decline to $0.70 by age 74. By age 86, your purchasing power will be cut in half.

In short, 3 percent annual price inflation reduces each dollar you own to just $0.50 in less than 25 years. Without question, this is a significant loss in purchasing power.

What’s more, generating consistent investment income to overcome this loss in purchasing power is a tall order. Surely, you can’t rely on the government’s cost of living adjustments (COLA), which are tied to the CPI, to maintain your living standard.

How Uncle Sam Inflates Away Your Life

We doubt that the dollar devaluing effects of price inflation is a new concept for you. Most likely you’ve heard this many times before. Certainly, you experience it as you go about your business.

However, this stealthy destruction of your wealth bears repeating. The fact is over the course of your retirement half of your life-savings will be covertly confiscated from your bank account. We find this to be wholly intolerable.

Remember, your life-savings is just that. It represents your life. Specifically, it’s stored up time you traded a portion of your life to earn. So, too, it’s a measure of your financial discipline and ability to save and invest overtime in lieu of supersized spending.

When Uncle Sam confiscates your life-savings via the inflation tax something more is happening. Not only are you being robbed of your money, you’re being robbed of your life. Your life’s simply inflated away. Poof!

Factor in federal and state income taxes, social security, disability, Medicare, capital gains taxes, outrageous health insurance costs, subsidizing luxury electric vehicles and grape flavored soda pop, and a vast array of fees and exactions, it’s a miracle you have any money left over at all.

Alas, what money you somehow manage to hold onto will be inflated away long before you need it most.

Contact Ulli

Comments 2

On the other hand… If my wage and/or investments grow at or above the rate of inflation then maybe my $1,200/month house payment will be effectively cut in half in 20+ years. And does not deflation hurt some types of businesses? Especially farmers who borrow a lot to purchase a large farm implement and then see their farm’s income drop because of deflated crop prices?

Seems to me that inflation/deflation may be defined as a type of entropy and, must be treated as such, by carefully managing so that the rate is always kept slightly positive(inflation).

Another comment about “economic entropy”:

https://phys.org/news/2009-11-law-thermodynamics-economic-evolution.html