- Moving the Markets

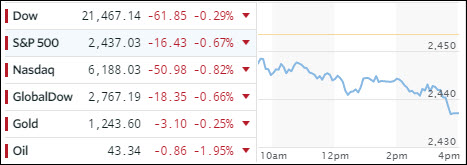

Equities were not able to overcome the spanking that took place in oil patch and energy sector with oil touching the $42 handle and tumbling to the lowest level since last November. The transportation sector was affected as well with IYT sinking -1.73% and Natural Resources IGE dropping -1.41%. The Financials (IYF) headed south as well but to a lesser degree.

The Volatility Index (VIX) managed to climb above 11 and settled at 10.86 for a gain of +4.73%. As a result, the major indexes could not muster the usual last hour ramp as something was noticeably absent, and that was the dip buyers.

I talked about the flattening yield curve yesterday, which can function as a leading indicator to tell possible improvements in economic activity or forecast a potential recession. The 5/10 year bond yields are now at its flattest since 2007, which is the same flatness we saw when the last two recessions started, according to ZH.

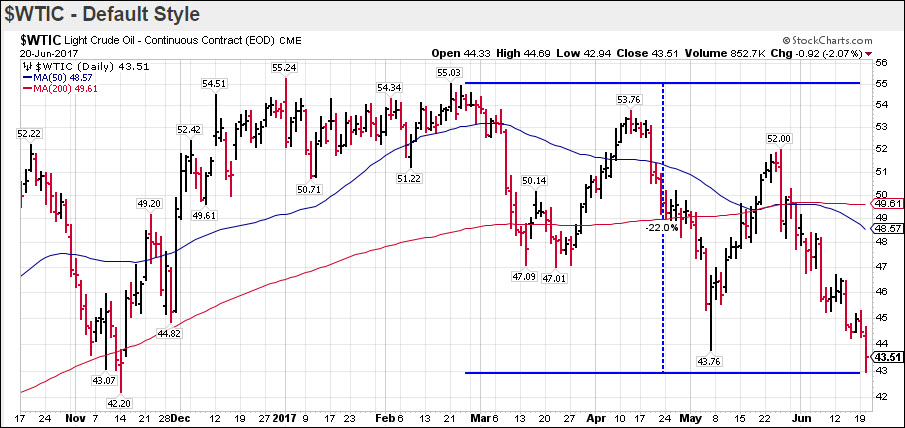

Back to crude oil, the direction of which can also serve as a harbinger of things to come. With today’s drop, oil has now officially entered bear market territory, which is defined as a 20% plus drop from recent highs. I’ve charted this development below:

As you can see, WTIC has dropped -22% from its February highs, but it remains to be seen whether this could be the canary in the coalmine for equities or just an outlier event.

- ETFs in the Spotlight (updated for 2017)

In case you missed the announcement and description of this section, you can read it here again.

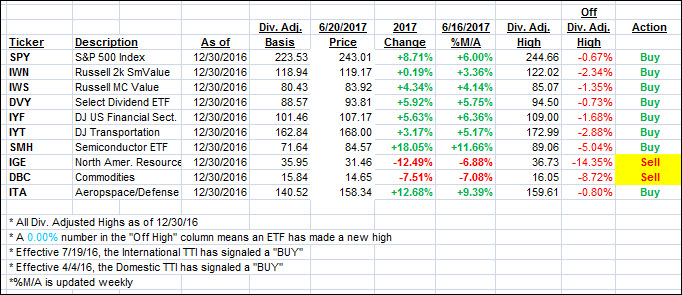

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the 2017 candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) pulled back as the major indexes closed at the lows for the day.

Here’s how we closed 6/20/2017:

Domestic TTI: +3.51% (last close +3.79%)—Buy signal effective 4/4/2016

International TTI: +7.30% (last close +7.87%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli

Comments 2

Hey, Uli

I see you have fallen in love with ZH. Could it be they’re the only permabears who share your (hidden agenda) CYA posts?

Seek out some other sources. I have little trouble finding reasons to be fully invested.

Smokey

6/20/17

Smokey,

It’s been one of my favorite reads. We are fully invested as the Domestic Buy has been in effect since April 2016. That does not mean all is well, and we need to be aware of the potential pitfalls lurking everywhere. I am just sounding words of caution, so investors don’t get blindsided as they did in 1987, 2000 and 2008.

Ulli…