Two weeks ago, HSBC’s Murray Gunn warned of “ominous signs” exuding from the US equity markets. This weekend, Citi’s Tom Fitzpatrick confirmed the concerns exclaiming Travolta-esque “[we’ve] got chills [about the market], and they’re multiplying… and they’re losing control.”

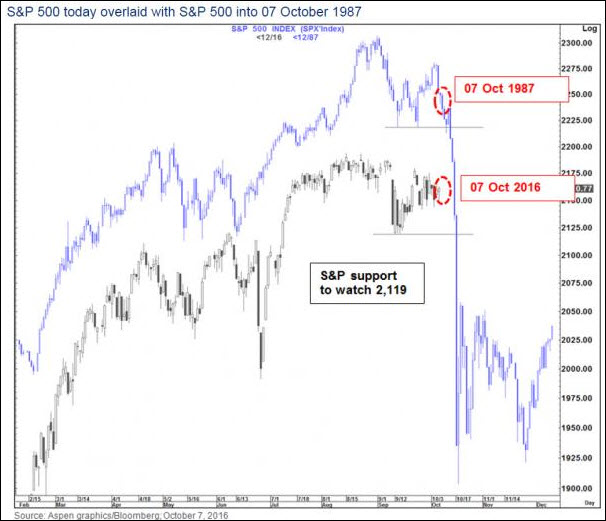

While fully realizing that you can find a lot of similar overlays if you look hard enough…this one gives us “the chills”.

At a time when we have seen:

– Elevated concerns about Europe and its banks (possibly even creating some US/Europe conflict)

– The most polarizing US Presidential election in modern times

– Increased “taper talk” emanating from Japan and Europe and rising concerns about the efficacy of the Central bank policy around the World and the possibility it becomes unhinged.

– A 20 basis point move in US 10 year yields in 5 days;

– A 16% move in Oil in 7 days;

– A $90 move in Gold in 9 days;

– A chart on USDCNY that looks to be breaking to the topside and a huge GBPUSD move overnight in minutes

Is this the next shoe to drop?

Source: Citi

As HSBC noted previously, a close in the Dow below 17,992 would be a clear warning that a steep fall could be underway.