Authored by Jesse Felder of TheFelderReport.com,

Authored by Jesse Felder of TheFelderReport.com,

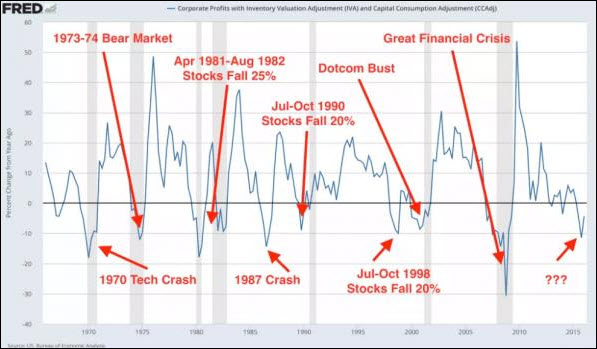

It’s earnings season once again and it looks as if, as a group, corporate America still can’t find the end of its earnings decline since profits peaked over a year ago. What’s more, analysts, renowned for their Pollyannish expectations, can’t seem to find it, either.

So I thought it might be interesting to look at what the stock market has done in the past during earnings recessions comparable to the current one. And it’s pretty eye-opening. Over the past half-century, we have never seen a decline in earnings of this magnitude without at least a 20% fall in stock prices, a hurdle many use to define a bear market.

In other words, buying the new highs in the S&P 500 today means you believe “this time is different.” It could turn out that way but history shows that sort of thinking to be very dangerous to your financial well-being.

Contact Ulli