1. Moving the Markets

Markets are on a 3-day run heading into the end of May and it seems that a ‘Rally Cry’ is on the tip of everyone’s tongue despite China devaluing their currency to the lowest in 5 years and the U.S. services industry tanking. So, what is driving markets higher this week? A continued rise in oil prices and a flexing of strength in the housing market. Both of these signal that the economy and the market overall can allegedly withstand a (tentative) rate hike.

U.S. crude oil gained substantially today closing up 2.18% at $49.68 a barrel. Many analysts are saying that if the commodity pushes above $50 a barrel, that the bulls can once again blow some steam out their nose and start kicking the dirt. So, let’s keep an eye on oil prices heading into the summer.

As investors are watching the Fed and their deliberations over hiking rates, one other commodity has been hit hard. That commodity is gold. The precious fine metal is at a seven-week low, now priced at $1,222.85 per ounce and U.S. gold futures have fallen accordingly. Adding to the downtrend of Gold has been the continued rise in the USD, which still stands near a two-month high against a basket of major currencies.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

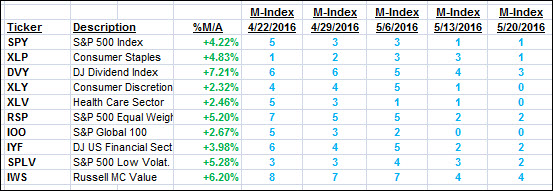

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

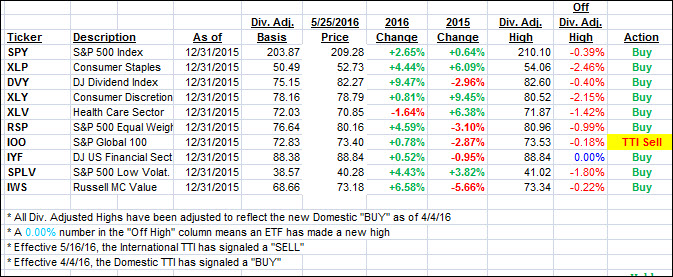

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) moved deeper into bullish territory with the International one improving as well. Again, on the international side, I will wait for more upside confirmation before considering this move a new BUY signal.

Here’s how we ended up:

Domestic TTI: +1.65% (last close +1.43%)—Buy signal effective 4/4/2016

International TTI: +0.75% (last close +0.01%)—Sell signal effective 5/16/2016

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli