1. Moving the Markets

All three U.S. benchmarks began the day in positive ground, before sliding back. About mid-afternoon, they faltered into negative territory, ending at session lows by the closing bell.

The buzz of late has been all about earnings expectations and how the market will react. If earnings come in negative in the January-March quarter as expected, it will mark the third straight quarter of negative growth. Profits were hurt by financial turbulence, a strong dollar that hurt sales of U.S. multinationals and the continuing fallout from low prices in the energy patch.

The unofficial kickoff to earnings season came after the closing bell when aluminum giant Alcoa (AA) reported its results, which topped analysts’ sharply crushed expectations. While revenues fell 15% YOY, a 6% gain was offset by a 21% decline caused by low aluminum prices and a strong dollar. This was accomplished via extremely creative accounting magic, as you can read here.

Moving forward, let’s keep in mind that Wall Street will be closely watching financials, commodities and the impact of the dollar on corporate profit results. Financials face continued headwinds due to a small gap between short-term and long-term interest rates, as well as early-year market turbulence that negatively impacted trading results. And despite a sharp recovery in energy prices, analysts continue to mark down earnings in the energy sector as non-performing loans are looming on the horizon.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

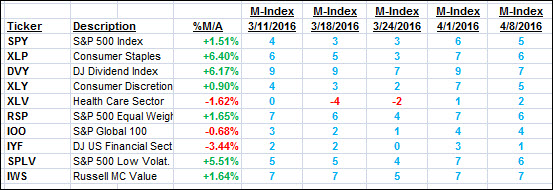

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

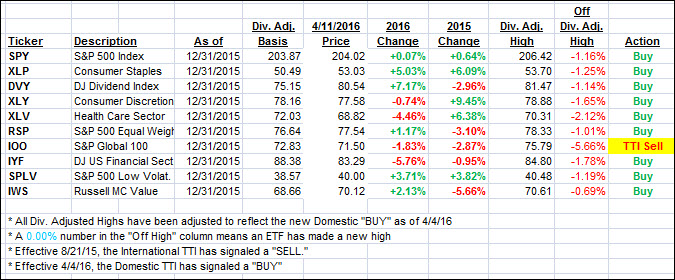

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) slipped as the major indexes ran out of steam and closed to the downside.

Here’s how we ended up:

Domestic TTI: +1.05% (last close +1.19%)—Buy signal effective 4/4/2016

International TTI: -2.81% (last close -2.72%)—Sell signal effective 8/21/2015

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli