ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

FLAT ON WALL STREET TODAY BUT UP FOR THE WEEK

1. Moving the Markets

Stocks, perhaps a little winded by a massive rally earlier in the week, turned in an uninspiring showing today as investors reacted to softer oil prices and digested a fresh reading on inflation at the consumer level that could influence interest rate policy.

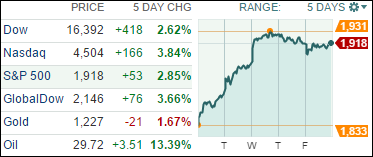

Despite the snoozer of a finish, all three market measures posted their biggest weekly gains yet in 2016. As the chart shows, the Dow gained 2.62% in the holiday-shortened week, the S&P rose 2.85% and the Nasdaq jumped 3.84%. The shorts have all been squeezed to cover, so we’ll have to see if there is another driver to continue the current upswing. My guess is that we’ll run out of steam pretty quickly, especially if oil heads south again.

In economic news, the January consumer price index, or CPI, was unchanged, a tad better than the 0.1% drop economists had forecast. The so-called core CPI, which strips out food and energy costs, rose a bigger-than-expected 0.3%, or a year-over-year pace of 2.2%. The stronger inflation reading could have implications for Federal Reserve interest rate policy, as a big reason the nation’s central bank has been holding off on more interest rate hikes is due to still-weak inflation readings.

Also today, tech investors were reacting to news that the board of troubled Internet Company Yahoo (YHOO) has formed an independent committee to explore “strategic alternatives,” which in Wall Street-speak normally means a potential sale may be in the works.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

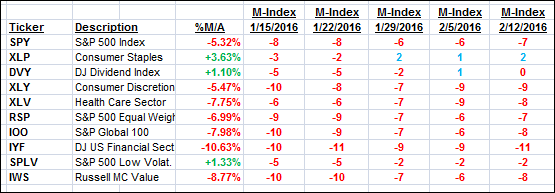

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

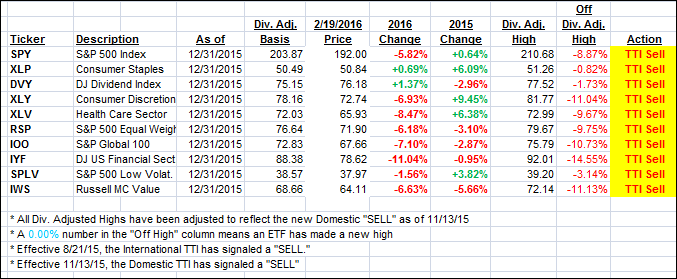

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) declined as the markets rebounded but remains on the bearish side of its trend line as follows:

Domestic TTI: -2.04% (last Friday -3.19%)—Sell signal effective 11/13/2015

International TTI: -9.19% (last Friday -12.31%)—Sell signal effective 8/21/2015

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli