ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

DIGGING OUT OF A HOLE

1. Moving the Markets

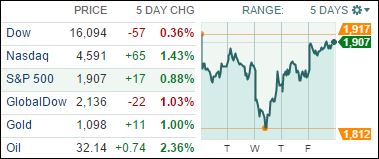

Wall Street stocks scored a second day of gains Friday after a steep sell-off earlier in the week as oil prices bounced sharply higher and investors banked on further stimulus measures from global central banks. Major indexes were higher on the week, with telecom leading advancing sectors and financials the only declining sector. Even after this week-ending rebound, all three U.S. stock indexes remain in correction territory, commonly defined as a drop of 10% or more from recent highs and, of course, confirmed by our Domestic TTI being trapped below its long-term trend line.

Powering Day 2 of the rebound was a big rally in the oil patch, where a barrel of U.S.-produced crude was up more than 8% and back above $32 a barrel. Plunging crude prices, of course, have weighed on stocks this year, as it has raised fears of a coming global slowdown and worries that bankruptcies and upheaval in the oil sector would exacerbate financial tumult.

Economic news was mixed overall for the week, with housing and manufacturing data representing the most significant releases of the week. While the pace of U.S. economic growth appears to have slowed some more recently, it continues to remain on plus side—so far but only barely.

Heading into next week, Wednesday’s Federal Open Market Committee (FOMC) rate decision should be the marquee event of the week. Other major economic reports include the S&P/Case-Shiller home price index and consumer confidence on Tuesday, durable goods orders on Thursday, and fourth-quarter GDP on Friday.

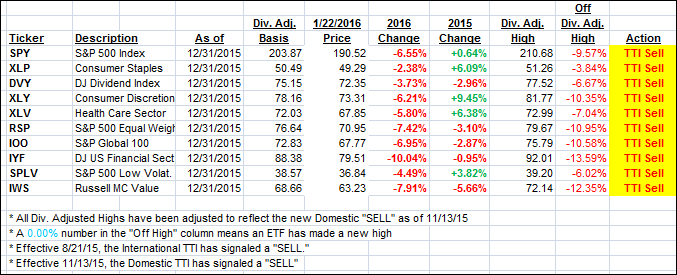

All of our 10 ETFs in the Spotlight joined the 24-hour party and closed up with the Global 100 (IOO) leading the pack with a gain of +2.43%, while Consumer Staples (XLP) lagged but still showed a good performance with +1.71%.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

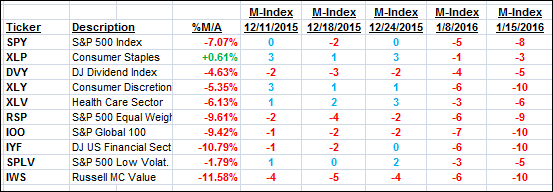

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) finally headed north as the major indexes staged a rebound. Nevertheless, we remain in bear market territory as long as the trend line does not get broken to the upside.

Here’s how we closed this week:

Domestic TTI: -2.78% (last Friday -3.56%)—Sell signal effective 11/13/2015

International TTI: -10.16% (last Friday -11.51%)—Sell signal effective 8/21/2015

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli