1. Moving the Markets

Stocks rallied early in the day, but the momentum faded by closing time as investors remained jittery about global economic growth, conflict abroad and now ebola at home. This could have ended up to be a negative day had time not run out.

Ebola has had quite an impact on the human condition over the past month, but some investors are realizing some hefty gains on the disease. Lakeland Industries (LAKE) and Alpha Pro Tech (APT) make hazmat suits, which are full body suits that healthcare workers wear when treating diseased patients. Lakeland’s stock is one of the biggest gainers since the breakout of ebola, jumping up from $7 a month ago to as high as $28 and settling today at $21.43. Other manufacturers of these suits include DuPont (DD), Kimberly Clark Corp (KMB), and Honeywell International Inc. (HON).

With Black Friday around the corner, Macy’s (M) made the first aggressive move to seek higher profits, as it announced today that they will open stores earlier this year, at 6 pm on Thanksgiving to be exact. Macy’s is the first major retailer to announce store hours for the Black Friday weekend.

Finally, oil took a big hit today, as the International Energy Agency cut its demand forecasts for 2014 and 2015 by 200,000 and 300,000 barrels per day, respectively. Perhaps, this means a continued decline in prices at the pump.

With the markets having been on a breathtaking roller coaster ride, it’s better to be safe than sorry. Just today I saw a comment from a seasoned investor on another blog that described the current situation very well:

In the past 5 days, I’ve hit 15 of my trailing stops. I just placed another batch of sell orders. All I have left is mostly cash, precious metals, and bonds. I had a lot of energy MLPs in my taxable account and they have been massacred – oil, gas, coal, midstream – everything. Buy-write funds ditto [funds that use a covered-call options strategy]. I have a few stocks left, but it’s pretty skimpy.

But one thing I’ve learned to never ignore: trailing stops despite fear of a whipsaw. I have always regretted waiting.

There is a lesson in his comment.

7 of our 10 ETFs in the Spotlight managed to eke out a small gain as the mid-day rally shifted in reverse.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

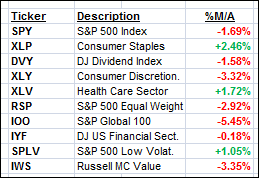

While our Trend Tracking Indexes (TTIs) are in “Sell” mode, I am featuring this table to simply demonstrate the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A).

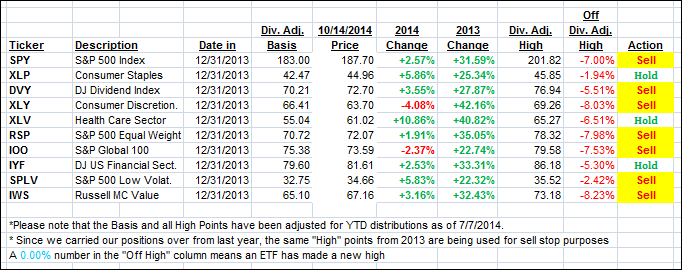

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column.

The “Action” column has been modified to show the effects of our Sell signals. The current “Hold” positions reflect only sector ETFs, which should be sold based on their respective sell stop points.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) came off their lows during this volatile session. As I mentioned yesterday, I watched the day unfold and, as the early rally started to reverse, I liquidated some of our remaining position leaving us with only one sector ETF. That one will be on the chopping block as well, if and when it triggers its respective sell stop.

Here’s how we closed the day:

Domestic TTI: -0.81% (last close -1.00%)—Sell signal effective 10/14/2014

International TTI: -5.33% (last close -5.62%)—Sell signal effective 10/1/2014

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli