1. Moving the Markets

It seems that international concerns trumped domestic economic outlook as market movers today, in that we received encouraging reports on economic growth, jobs and housing. Stocks dropped back below the 2000 mark on renewed concerns over the conflict in Ukraine. The major indexes came off their highs as the chart above shows.

Reports came in today that the economy grew faster than previously thought in the second quarter, as the government revised the growth in GDP to 4.2%, up from an earlier estimate of a 4% annual rate. Also, we heard that weekly jobless claims fell by 1,000 to 298,000 last week.

In the banking world, shares of JP Morgan (JPM) dropped today after a news report was released that the bank, and possible four other banks, were hit by cyber attacks. The FBI said it was working with the U.S. Secret Service “to determine the scope” of the attacks. JPMorgan CEO Jamie Dimon said his bank spends about $200 million each year to protect it from cyber attacks, according to his April 2013 letter to shareholders.

3 of our 10 ETFs in the Spotlight edged up slightly; no new highs were made.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

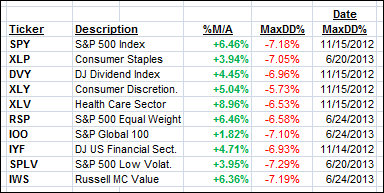

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

All of them are currently in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

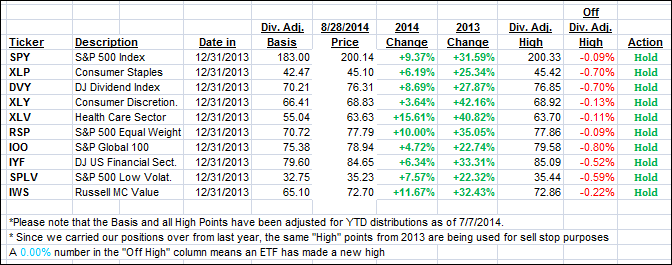

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) pulled back a tad from yesterday’s close:

Domestic TTI: +3.21% (last close +3.27%)

International TTI: +2.66% (last close +2.98%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli