1. Moving the Markets

Comments from Russia, which were interpreted as conciliatory, turned into an assist for the markets despite some less than inspiring earnings reports.

All the major indexes gained with only slight pullbacks throughout the day, as the chart above shows. 9 of the S&Ps sector indexes rose, with healthcare taking top billing while energy slid some 0.5%.

Russian President Putin’s words that Russia will stand up for itself but not at the cost of confrontation with the rest of the world was exactly what Wall Street wanted to hear, and off to the races we went.

On the earning front, WalMart’s (WMT) report card met expectations but cut its forecast for coming quarters. On the downside, Cisco (CSCO) dropped 2.6% as a result of its meager outlook for the current quarter along with massive job cuts; all in the face of reporting revenues above expectations.

In a repeat from yesterday, all of our 10 ETFs in the Spotlight gained for the day, although no new highs were made.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

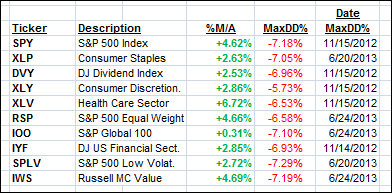

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

10 of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

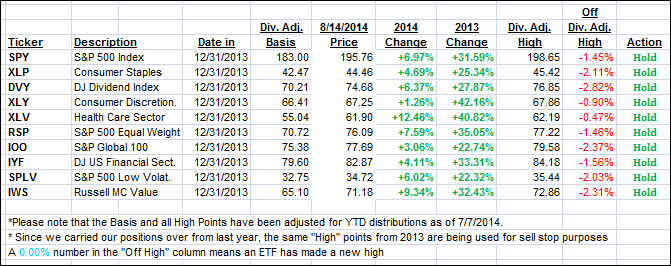

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed higher with the Domestic one showing stronger upward momentum:

Domestic TTI: +2.30% (last close +2.07%)

International TTI: +1.42% (last close +1.05%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli