1. Moving the Markets

The major indexes here in the U.S. ended lower today, despite a favorable jobs report from the Labor Dept that showed job openings are at their highest level since February of 2001. The S&P 500 dropped 0.15%, the Dow finished down 0.05% and the Nasdaq slipped 0.28%.

For all you lovers of Kate Spade handbags, today was not all “shiny leather” for owners of the stock. Kate Spade & Co (KATE) took a dive today by 25% to close at $29 a share amidst heavy trading volume when the company warned that gross margins would be weaker than expected for the year.

King Digital Entertainment (KING) also took a tumble today after it reported that the online game maker generated less revenue than Wall Street had expected. Shares dropped over 20% to end the day around $14 a share. The CEO Riccardo Zacconi was quick to unveil a special dividend of $150 million to investors, but that didn’t seem to be enough to keep the stock from trending lower.

In international news, investors are still keeping a close eye on Russia, which sent a 280 truck convoy of humanitarian aid to eastern Ukraine today. While Russia is ‘playing nice’ at present, many remain uncertain as to where the conflict is headed in the near future, especially given Russia’s recent decision to boycott U.S. agricultural imports.

In a reversal from yesterday, of our 10 ETFs in the Spotlight, 9 retreated and 1 inched up slightly.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

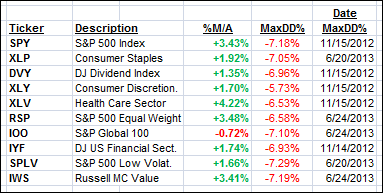

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

9 of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

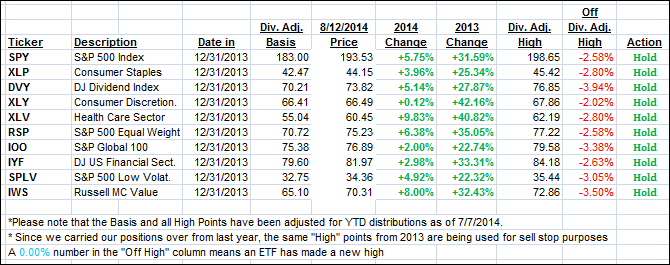

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) eased as little to close as follows:

Domestic TTI: +1.63% (last close +1.82%)

International TTI: +0.66% (last close +0.75%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli