1. Moving the Markets

The Dow kept trucking forward further into record territory for a fourth straight day, ending the day up 0.5% at a new all-time high of 17,138.20. The S&P 500 and Nasdaq also rode the momentum of the blue-chip index higher, gaining 0.44% and 0.22% each.

Numerous investor eyes turned to Time Warner Cable (TWC) as news emerged of a potential $80 bil takeover bid by Rupert Murdoch’s 21st Century Fox. Other media stocks also got a boost from the news: Viacom (VIA) was up 3.5%, CBS (CBS) gained 2.1% and Disney (DIS) gained 6%.

In the tech world, recent musings about Apple (AAPL) and IBM (IBM) potentially teaming up to develop mobile apps together became a bit more confirmed today. Apple gained 0.6% and IBM added 2.3%. Also, we received a favorable earnings report today from Intel (INTC) and shares shot up 8% subsequently.

Finally, you may remember a couple of days ago I mentioned the upcoming economic growth report due from China. Well, we received the numbers today, and the report showed that the world’s second-largest economy expanded 7.5% year-over-year, which was slightly above the 7.4% growth numbers from Q1.

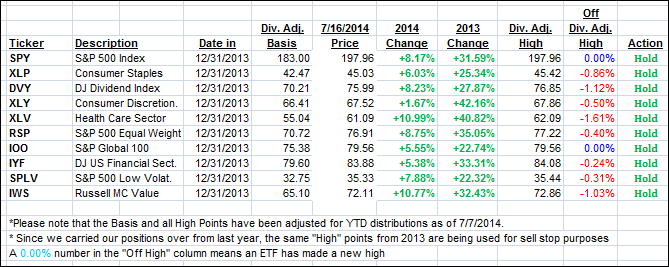

Our 10 ETFs in the Spotlight picked up momentum with 2 of them making new highs today.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

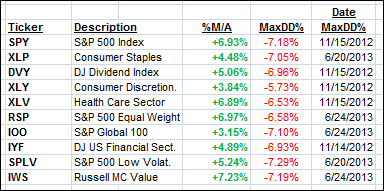

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

All of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed as the domestic one barely moved while its international cousin showed more strength:

Domestic TTI: +2.99% (last close +2.97%)

International TTI: +3.77% (last close +3.35%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli