1. Moving The Markets

The markets stayed in the green zone after a minimal amount of economic news to trade on and no major M&A announcements. All major indexes showed small gains for the day.

There was a decent amount of news in the tech world today. Internet domain registration company GoDaddy finally pulled the trigger on its move towards an IPO. The company has filed its prospectus to sell $100 million-worth of shares to the public, ending months of speculation. The initial public offering makes GoDaddy the last Internet darling to take advantage of the open window for new stock offerings.

Well, those hoping that the U.S. would regain its premier status as a top credit rated borrower saw their hopes wash away today. Credit ratings agency Standard & Poor’s reaffirmed its AA+ rating on U.S. debt. Some optimists have been hoping that the U.S. could regain its AAA rating, after losing it on Aug. 5, 2011 following the damage of the financial crisis. Most analysts are citing elected officials’ inability to react swiftly and effectively to public finance pressures.

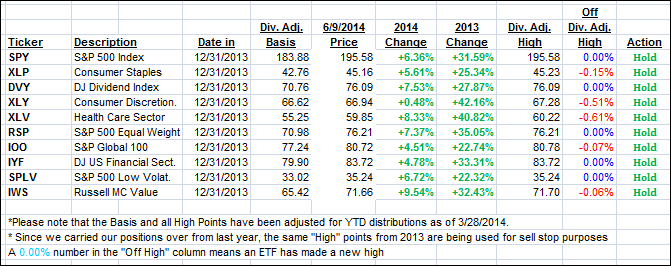

Our 10 ETFs in the Spotlight inched higher; 5 of them made new highs today while all 10 of them are now on the plus side YTD.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

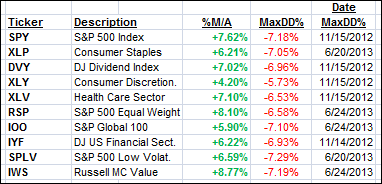

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) inched up slightly:

Domestic TTI: +3.65% (last close +3.55%)

International TTI: +4.92% (last close +4.85%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli