1. Moving The Markets

There was not much movement up or down in the U.S. equity markets today. Both the S&P 500 and the Nasdaq closed slightly in the red zone, while the Dow managed to squeeze out some positive gains. Utilities and technology companies led sector losses. The trend continues to be investors selling out of big growth and momentum stocks and moving into less risky value stocks.

Keurig Green Mountain and Twenty-First Century Fox were among the winners after reporting earnings, while electric carmaker Tesla slumped. Tesla Motors (TSLA) fell $19.72, or 9.8%, to $181.67, after the company reported a $49.8 million first-quarter loss late Wednesday and said that reinvestment in the company would weigh on earnings later this year.

In Europe, European Central Bank President Mario Draghi said today that the ECB is ready to cut interest rates next month if needed and expressed concern about the euro’s exchange rate. There seems to be a growing assumption amongst international investors that the ECB is going to start a quantitative easing program. Thus, we have seen more and more investors pouring cash into the euro-area bond markets amid optimism the ECB will step in to support the debt.

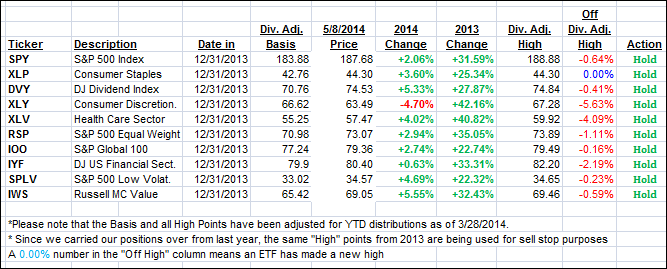

Our 10 ETFs in the Spotlight went sideways with one of them making a new high; 9 of them remain on the plus side YTD.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

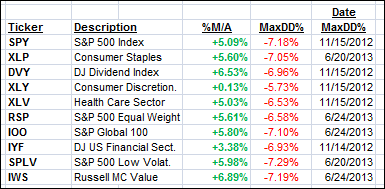

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) went nowhere and closed as follows:

Domestic TTI: +2.03% (last close +2.14%)

International TTI: +3.37% (last close +3.27%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli