1. Moving The Markets

U.S. stock markets continued their rally today, driven largely by positive corporate news and earnings announcements. The major indexes all gained as the chart above shows. The health-care sector led the eight of ten S&P 500 sectors that finished higher on the day. Driving health-care gains was the news from the pharmaceutical space that British drug giant GlaxoSmithKline (GSK) will sell its cancer-products business to Novartis AG (NVS) for $14.5 billion. At the same time, Novartis AG said separately that it will sell its animal health division to Eli Lilly (LLY) for $5.4 billion. Shares of Glaxo and Novartis gained 5% and 1.2% respectively, while Eli Lilly shares gained 1.5%

Netflix (NFLX) was back in the news today as it announced that it will raise prices in the near future on its streaming services, but for new customers only. Existing subscribers will hold on to the current monthly rate. The news from Netflix that really grabbed investors’ attention though was their reporting net profit of 86 cents per share during the first quarter, which topped both internal and Wall Street forecasts. The company also reached 48 million subscribers, which was much faster growth than anticipated.

Align Technology (ALGN), Apple (AAPL), Biogen Idec (BIIB) and Facebook (FB) are among companies due to report quarterly earnings Wednesday. Let’s keep the good corporate earnings news rolling in! Also, economic data scheduled for Wednesday will include new-home sales for March and the Mortgage Bankers’ Association’s weekly mortgage applications index.

Our 10 ETFs in the Spotlight headed higher with 1 of them making a new high today while 9 remain on the plus side YTD.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

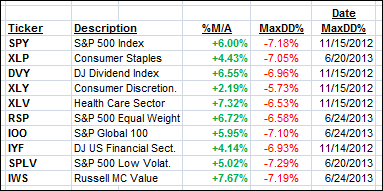

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

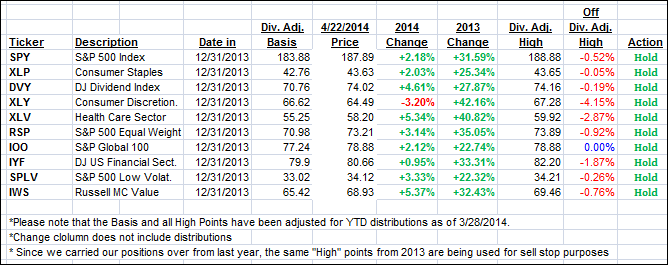

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed with the Domestic one staying just about even while the International one inched higher:

Domestic TTI: +2.45% (last close +2.48%)

International TTI: +3.68% (last close +3.41%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli