1. Moving The Markets

U.S. stocks fell today, erasing most of the S&P 500’s year-to-date gain, as banking and technology stocks led the selloff. The S&P 500 lost 0.19%, the Dow dipped 0.03% and the Nasdaq Composite dropped 0.54%. The S&P was able to remain above 1,840 though, which has become a benchmark support level recently.

New data released today showed that the U.S. economy grew a bit faster than previously estimated in the Q4 2013, while new claims for jobless benefits dropped to a near four-month low last week. But contracts to buy previously owned homes fell in February to their lowest level since October 2011.

Concerns about the effect of sanctions on Russia’s energy sector and global supplies helped push crude oil prices and the S&P energy index (SPNY) higher. In addition, Exxon Mobil Corp (XOM) gained 1.6% to $96.24 after Bank of America Merrill Lynch boosted its rating on the stock to “buy”.

All of you Apple (AAPL) addicts out there who have been disgruntled at the fact that you could never use Microsoft Office products on your tablet can finally rejoice because Microsoft unveiled Office for iPad today. At a news conference, executives demonstrated a new “touch-first” version of Office crafted for the iPad, available for download as a free app, though a subscription is needed to let users create or edit documents rather than just read them. Analysts have estimated that Microsoft (MSFT) could rake in anywhere from $840 million to $6.7 billion a year in revenue from an iPad-native Office.

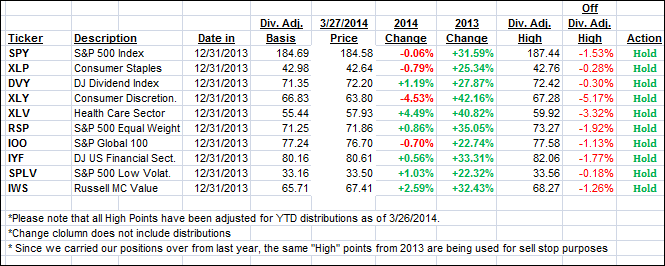

Our 10 ETFs in the Spotlight went nowhere with 6 of them remaining on the plus side YTD.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

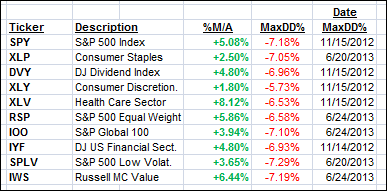

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) barely changed, which was not surprising given today’s sideways activity:

Domestic TTI: +2.62% (last close +2.67%)

International TTI: +3.21% (last close +3.07%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli