1. Moving The Markets

Stocks here in the U.S. had their best gain in 7 weeks today. The S&P 500 (SPX) closed up 1.24%, the Dow (DJIA) closed up 1.22% and the Nasdaq Composite (COMP) finished the day 1.1% higher. What seemed to have the biggest impact on markets today was the data on weekly jobless claims. Data was released that showed the number of people who applied for unemployment benefits for the first time fell by 20,000 to 331,000 last week, which was 6,000 better than the forecasted 337,000

Green Mountain Coffee Roasters (GMCR) exploded upwards 26% today after releasing the news that Coca-cola (KO) will take a 10% stake in the company for $1.25 billion alongside a 10-year drink deal. Disney (DIS) was one of the Dow’s big gainers today. Shares increased 5.3% after its earnings topped estimates, drawing on big gains from the recent blockbuster “Frozen”.

Across the globe, European stock markets reacted positively to the news that the European Central Bank has decided not to change interest rates from their current 0.25% level. Some analysts had thought it might cut rates down to 0.1%. Weak growth and an unexpected drop in inflation have raised concerns that the eurozone might slide into deflation, which could cripple the economy. Asian stocks performed relatively well today apart from the Nikkei.

Our 10 ETFs in the Spotlight recovered as well with only 2 of them hovering below their respective long-term trend lines.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

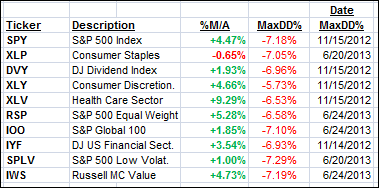

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

8 of them remain in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

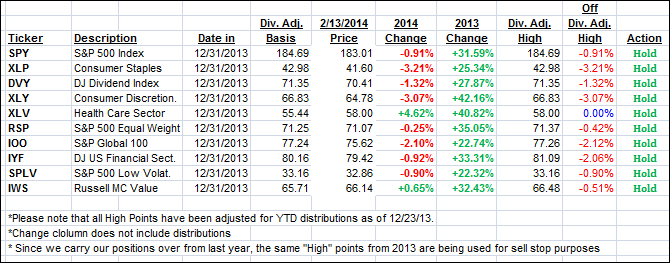

Year to date, here’s how the above candidates have fared so far:

Keep in mind that the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A) while the second one tracks their trailing sell stops in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) followed the indexes higher in this roller coaster week and closed as follows:

Domestic TTI: +1.87% (last close +1.31%)

International TTI: +3.10% (last close +1.90%)

Contact Ulli