1. Moving The Markets

Overall, the markets held up well today. By the end of trading some major indexes posted gains while others dipped slightly. Some analysts say that the S&P 500 may be hitting a key resistance level as we have seen the index approach, but fail to break through its all-time high over the past few days of trading.

We received some positive economic news today that may have helped drive market gains. New home sales numbers came in at 468,000 units (annualized) for the month of January, which was well above the forecast even as mortgage rates have increased slightly over the past few months. Employment numbers will be coming out over the next two days that will shed some light on initial and continuing jobless claims. So, keep an eye on how investors react to this data.

Well, once again Tesla (TSLA) is on fire. The stock gained another 3% today and has gained more than 30% since reporting much stronger-than-expected profit and raised sales targets last week. Tesla debuted on the stock market in 2010 at less than $20 a share. Tesla bulls are betting that Tesla will grow from a niche player to a full-scale automaker to rival Ford (F), Toyota (TM) and General Motors (GM). One bit of info driving investor sentiment is the fact that the company is expected to officially announce plans to open a new lithium battery factory, dubbed the “Gigafactory,” which a spokesman from Tesla said should have capacity equal to all factories making such batteries around the world.

Our 10 ETFs in the Spotlight went sideways with the major indexes with 5 of them having turned positive for the year.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

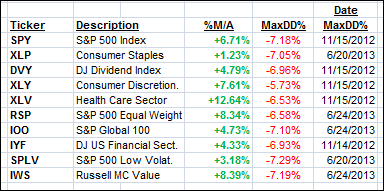

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

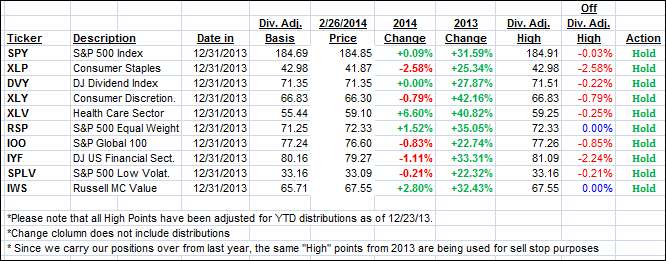

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed with one of them gaining and one of them losing:

Domestic TTI: +3.97% (last close +3.84%)

International TTI: +6.32% (last close +6.65%)

Contact Ulli