1. Moving The Markets

Stocks etched up higher today to kick-off the week of Feb. 10. Trading was fairly light today most likely due to the fact that Janet Yellen is scheduled to make her first congressional testimony tomorrow. Why would investors be awaiting such an event? Well, many believe that the Fed might be having reservations about the tapering issue, especially after the lackluster jobs report that was issued last Friday.

Tesla was a top gainer today as the Chinese government made an announcement that it will extend subsidies for electric car manufacturers. The stock finished up 5.38% for the day and is now up 24% for the year. Alexion Pharmaceuticals (ALXN) had a heavy day of trading and gained 3% to a new high after its recently announced strong earnings report.

As we all know, U.S. stocks and emerging markets have been volatile thus far in 2014. How have domestic interest rates been reacting to this? Interest rates have been following stocks lower. Now, the benchmark 10-year note is yielding 2.7%, which is a decline of roughly 30 bps since the beginning of 2014. This makes sense, because investors who are pulling out of the perceived risky emerging markets are subsequently seeking shelter in government treasuries, thus driving rates lower. However, when rates fall there are some ETFs in the rate sensitive corners of the market that benefit, notable Utilities, Real Estate and Homebuilders. Keep an eye on these 3 sectors if both domestic and emerging market uncertainty persists.

Our 10 ETFs in the Spotlight changed only slightly with 9 of them remaining on the bullish side of their respective trend lines as the tables below show.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

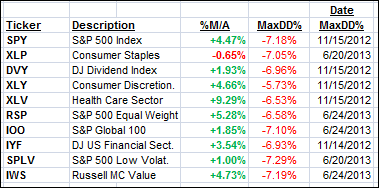

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them, except XLP, are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

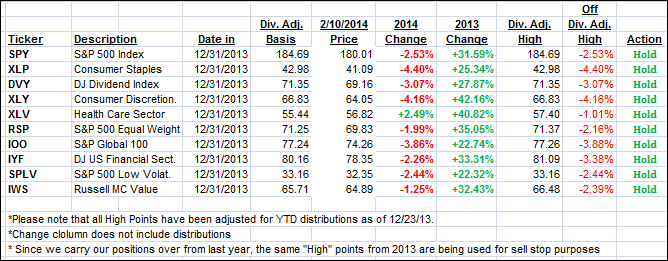

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column.

Personally, I liquidated our holdings in XLY and XLP last week, as their trend lines were broken to the downside. While the past 2 days showed a reversal, I will look for opportunities elsewhere and not repurchase XLY and XLP at this particular time.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed with the Domestic TTI staying unchanged and the International TTI dropping slightly:

Domestic TTI: +2.63% (last close +2.63%)

International TTI: +4.16% (last close +4.32%)

Contact Ulli