ETF/No Load Fund Tracker Newsletter For Friday, February 21, 2014

ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, February 21, 2014

WEEK IN REVIEW

[Chart courtesy of MarketWatch.com]1. Moving The Markets

Friday ended the week on a bit of a sour note given that markets had performed relatively well for the last few days. Today, Priceline (PCLN) gained 2.5% and Intuit (INTU) was up 4.6% after beating earnings estimates. Amazon.com (AMZN) was slightly lower after reports it will list brands such as Ralph Lauren.

A lot of investor news this week seemed to center on the major M&A deals that were announced. Last week, Comcast (CMCSA) said it’s acquiring Time Warner Cable (TWC). Later we heard that Apple’s (AAPL) M&A people were talking with Tesla (TSLA). Then came the blockbuster deal: Facebook (FB) is buying WhatsApp for $16.4 billion.

Perhaps the most disturbing of these deals is the Time Warner-Comcast deal. Many are worried that this may be too large a consolidation of entities that play a major role in not only how we view content, but also what content we view.

International stocks were higher after the prior day’s slump as the Bank of Japan’s January meeting minutes indicated that its aggressive stimulus could persist for more than the market’s expectation of two years. The USD fell against the euro on Friday after weak US housing data stoked concerns about the American economy, but notched its first week of broad gains against a basket of major currencies in three weeks.

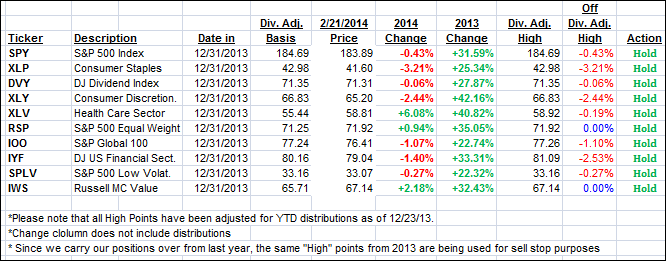

Our 10 ETFs in the Spotlight held steady and 3 of them have now turned positive for the year.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

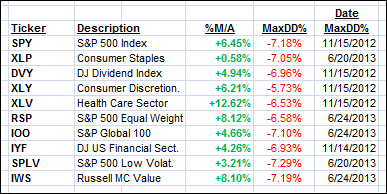

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) meandered sideways and closed only slightly changed from the prior week.

Domestic TTI: +3.45% (last Friday +3.58%)

International TTI: +6.12% (last Friday +5.65%)

Have a great week.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Kathy:

Q: Ulli: Two days ago your newsletter said you liquidated these positions but today’s charts are still showing a hold? Am I missing something?

A: Kathy: As I mentioned in the NL, I am tracking 2 different items in the 2 tables. The first one shows any trend line breaks, some of which happened, while the second one tracks the trailing sell stops.

I did sell my positions on a break below the trend line, but you can use the trailing sell stops as well. It all depends on your risk tolerance.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli