ETF/Mutual Fund Data updated through Thursday, January 9, 2014

If you are not familiar with some of the terminology used, please see the Glossary of Terms.

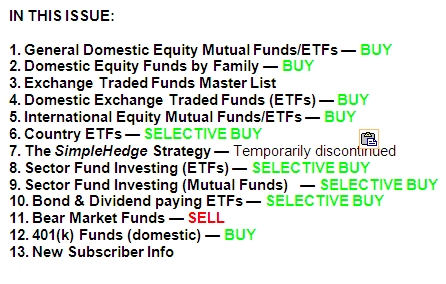

1. DOMESTIC EQUITY MUTUAL FUNDS/ETFs: BUY — since 10/25/2011

Our main directional indicator, the Domestic Trend Tracking Index (TTI), broke through its long-term trend line generating a Sell for this area effective 8/9/2011. Over the recent past, we’ve seen the TTI hovering slightly below and above this dividing line between bullish and bearish territory. The clear break to the upside occurred on 10/24/11 and, effective 10/25/11, a new Buy signal for domestic equities went into effect.

As of today, our Trend Tracking Index (TTI—green line in above chart) has bounced off its long term trend line (red) by +4.10%.

To avoid a potential whip-saw, a Sell signal to move out of all domestic equity positions will be generated once we have clearly pierced the line to the downside. Be sure to tune in for the latest updates.

The link below shows the top 100 domestic funds (out of 674) and the sorting order is by M-Index ranking. Prices in all linked tables are updated through 01/09/2014, unless otherwise noted. Price data not yet available at publication is indicated with 00.00% or -100.00%. Please note that year end mutual fund distributions are not included in the current momentum numbers.

Whenever the TTI is above the trend line, and therefore in ‘Buy’ mode, you can either use the tables in the links below to make your selections or choose one of the Model Portfolios featured every Wednesday:

http://www.successful-investment.com/SSTables/DomFundsTop100_010914.pdf

2. DOMESTIC FUNDS BY FAMILY: American Century, Fidelity, Vanguard, ProFunds, Rydex, T. Rowe Price — BUY

http://www.successful-investment.com/SSTables/DomFFs010914.pdf

3. EXCHANGE TRADED FUNDS MASTER LIST

As per request, I have added this ETF Master list so that you can quickly compare various ETFs without having to reference other tables. The ETFs listed in the table (476) consist of the following orientations: Domestic, International, Country, Sector and Specialty. Momentum figures for all ETFs are not adjusted for dividends.

Please note that I have moved all bear market ETFs to section 11, where they are listed alongside the bear market mutual funds.

http://www.successful-investment.com/SSTables/ETFMaster010914.pdf

4. DOMESTIC EXCHANGE TRADED FUNDS (ETFs): BUY

ETFs are an excellent alternative to No Load Mutual Funds. They are a valid choice to high mutual fund management fees, restrictive trading and redemption charges, which have been a problem for years.

All the same Buy and Sell rules apply for domestic ETFs as they do for domestic equity mutual funds in section 1.

http://www.successful-investment.com/SSTables/DomETFs010914.pdf

5. INTERNATIONAL EQUITY MUTUAL FUNDS/ETFs: BUY —since 08/21/2012

This index gapped above its long term trend line to the upside and is now positioned at +6.54%. As always, I recommend you use my suggested 7% trailing sell stop in order to limit downside risk, should the trend reverse all of a sudden.

The listings in the link below represent some of my choices of the international funds I track to be used during a Buy cycle. Please note that I have added Vanguard, Fidelity, T. Rowe Price, Rydex/ProFunds and American Century Funds. They are sorted by M-Index ranking:

http://www.successful-investment.com/SSTables/InternFunds010914.pdf

Be advised that many international funds may not be available to you since they carry a load. However, while I am able to purchase these for my managed account clients as ‘load waived’ funds, this doesn’t help you much, if you do your own investing. This is why I have included some appropriate ETFs in the above list.

6. COUNTRY ETFs: SELECTIVE BUY

While I believe that the United States is the greatest country in the world to live in, it is not necessarily always the best, or only one, to invest in.

This addition to my newsletter will allow us to also invest selectively in countries with better performing stock markets. With the proliferation of ETFs over the past years, we are now able to invest in a variety of countries using low cost index ETFs.

The chart shows the China Index as an example:

The link contains a list of various countries/regions, which I am tracking weekly. Please note that data in this table does not include adjustments due to distributions.

http://www.successful-investment.com/SSTables/CountryETFs010914.pdf

As you witnessed during the last couple of years, country funds can be volatile and the use of a trailing stop loss (I use 10%) is imperative to protect your portfolio from severe downside moves.

7. THE SimpleHedge STRATEGY: Temporarily discontinued

8. SECTOR FUND INVESTING (ETFs): SELECTIVE BUY

To diversify our portfolios, we always need to look for different opportunities to invest our money. The table of sector fund listings (ETFs) in the following link covers a broad spectrum of possibilities. The sorting order is by M-Index:

http://www.successful-investment.com/SSTables/SectorETFs010914.pdf

I personally invest no more than 5%-10% of portfolio value in any one sector and use a 10% trailing stop loss to minimize the risk.

9. SECTOR FUND INVESTING (Mutual Funds): SELECTIVE BUY

If you prefer using Fidelity’s wide variety of excellent sector funds, you will like this new addition. Here as well, sectors can be volatile, and I advise the use of a sell stop just as we do with ETFs.

The sorting order is by M-Index:

http://www.successful-investment.com/SSTables/SectorMFs010914.pdf

10. BOND & DIVIDEND ETFs: SELECTIVE BUY

If you prefer using ETFs for the generation of income, here’s a list of bond and dividend paying ETFs. It’s important to first look at how these instruments have held up in terms of momentum figures. Then you should visit your favorite financial web site to examine yield and other details.

Please note that data in this table does not include adjustments due to distributions.

http://www.successful-investment.com/SSTables/Bond_DivETFs010914.pdf

11. BEAR MARKET FUNDS: SELL

The above indicator represents our Short Fund Composite (SFC) to be used as a trend indicator for Bear Market Funds.

The SFC has now broken below its long-term trend line by -9.77%, which means we are in bearish territory. As in the past, I will not take any action until the domestic TTI (section 1) has clearly broken into bear market territory. My preference is to work with a hedged position, or remain in cash/bonds, as opposed to an outright short one.

Below are the most commonly available bear market funds/ETFs and their momentum figures:

http://www.successful-investment.com/SSTables/BearFunds010914.pdf

Please note that some of the above funds try to outperform the index they are tied to by the percentage stated. While this can enhance your returns it can certainly accelerate your losses as well. No matter which way you choose, be sure to work with a trailing sell stop and be aware that volatility will be your constant companion.

12. 401(k) FUNDS (domestic): BUY

The list (featured in the link below) displays commonly held 401(k) domestic equity mutual funds showing their latest momentum figures to go along with the Buy and Sell signals of the TTI in section 1. The same stop loss rules apply here as well.

Since fund choices are limited in any 401k plan, be sure to roll your assets into an IRA if you leave your job. Let me know if you need help with that.

In the meantime, however, you can benefit greatly by at least not buying the worst fund at the wrong time. If you follow our plan, you will never again buy one of those highly volatile sector funds, when you really should be out of the market altogether.

The sorting order is now also by M-Index.

http://www.successful-investment.com/SSTables/401k010914.pdf

13. New Subscriber Information

To get you a head start on more successful investing, please click on:

http://www.successful-investment.com/SellStopDiscipline.pdf

In case you missed it, you can download my latest e-book “How to beat the S&P 500…with the S&P 500,” here.

Disclosure:

I am obliged to inform you that I, as well as advisory clients of mine, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli