1. Moving The Markets

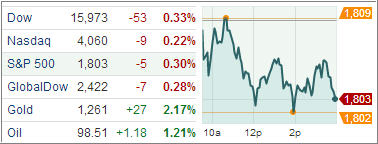

Stocks slipped in mixed volume as investors weighed a rise in job openings against concerns that the Federal Reserve will start to withdraw stimulus.

In the stock market today, Lumber Liquidators (LL) plunged 14% in huge volume, closing below its 200-day moving average, after its fourth-quarter earnings outlook came in slightly below expectations. Meanwhile, firearms maker Smith & Wesson (SWHC) was up sharply in post-session trading after its fiscal second-quarter earnings topped views. MasterCard (MA) was also up in the post-session after announcing a 10-for-1 stock split and boosting its quarterly dividend by 83%. Elsewhere, November new issue Twitter (TWTR) jumped 6% to a new high, blowing past a 50.19 buy point in a narrow IPO base.

Inflation has fallen to a four-year low of 1%, with core inflation just 1.7%, according to the latest consumer price index. With inflation continuing to cool, the Federal Reserve wants to see faster price gains. But the central bank may quietly favor a big inflation spike to rev up the economy. In the current sluggish economy, companies are hoarding cash and consumers are paying down debt. Inflation expectations would encourage businesses to invest to take advantage of lower — possibly negative — real interest rates.

In the ETF world, BNY Mellon has been named to support the db X-trackers Harvest CSI 300 China A-Shares Fund (ASHR) by providing custody, fund accounting, administration, and transfer agency services. The fund, launched on NYSE Euronext on 6 November, is the first Renminbi Qualified Foreign Institutional Investor (RQFII) exchanged-traded fund available to US investors to invest in physical Chinese equities listed on the Shanghai and Shenzhen exchanges. Don’t forget, BNY Mellon is the primary service provider to Deutsche Bank’s ETF business in the US, which now encompasses 27 funds.

Our ETFs in the Spotlight eased a bit as the YTD table shows:

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Now let’s look at the MaxDD% column and review the ETF with the lowest drawdown as an example. As you can see, that would be XLY with the lowest MaxDD% number of -5.73%, which occurred on 11/15/2012.

The recent sell off in the month of June did not affect XLY at all as its “worst” MaxDD% of -5.73% still stands since the November 2012 sell off.

A quick glance at the last column showing the date of occurrences confirms that five of these ETFs had their worst drawdown in November 2012, while the other five were affected by the June 2013 swoon, however, none of them dipped below their -7.5% sell stop.

Year to date, here’s how the above candidates have fared so far:

3. Domestic Trend Tracking Indexes (TTIs)

Trend wise, our Trend Tracking Indexes (TTIs) followed the major indexes lower but remain solidly entrenched on the bullish side:

Domestic TTI: +4.30% (last close +4.41%)

International TTI: +6.03% (last close +6.20%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli