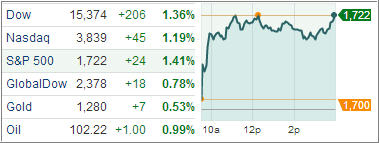

Domestic equity markets closed the trading session sharply higher as the fiscal stalemate on Capitol Hill is expected to possibly end a day before the Treasury’s debt ceiling is reached. The Senate is agreeing to a plan that will be voted on by the House later today.

The day’s gains brought the S&P 500 within a few points of its all-time closing high. Volume has been below average, however, as many investors stayed on the sidelines until a resolution of the fiscal issues was official. Meanwhile, Treasuries moved to the upside on the eased concerns about a U.S. debt default.

In earnings news, Bank of America, Dow member Intel, Yahoo, PepsiCo, and CSX all reported bottom-line results that exceeded analysts’ expectations. However, Stanley Black & Decker experienced heavy losses after cutting its full-year earnings outlook. Elsewhere, gold was lower; crude oil prices were higher, while the U.S. dollar was nearly unchanged.

Gains were broad, with all 10 S&P 500 sectors solidly higher. In another sign of easing concerns, the CBOE Volatility index sank 21 percent in its biggest daily drop since August 2011. However, the index remains up about 12 percent over the past four weeks.

Financials (+2.2%) ended the day in the lead. The sector received support from Bank of America and PNC Financial after both banks reported bottom-line beats. Thanks to today’s gain, the financial sector extended its October advance to 3.9%.

Outside of financials, only health care and energy hold month-to-date gains larger than 3.0%. The health care sector rose 2.0% today, and received support from shares of Abbott Labs after the drug maker beat on earnings.

Elsewhere, consumer staples (+1.4%) also contributed to the rally as PepsiCo ended higher by 2.1% following its earnings beat on in-line revenue. Although all sectors posted solid gains, industrials (+0.7%) trailed behind the remaining nine groups as defense contractors weighed.

Also of note, the Federal Reserve released its Beige Book, which did not contain many surprises. The report said economic growth during the period between September and early October continued at a “modest to moderate pace” while employment continued to grow modestly.

Our Trend Tracking Indexes (TTIs) joined the rally and ended the day as follows:

Domestic TTI: +3.53%

International TTI: +6.94%

Contact Ulli