U.S. equity markets closed mostly in the positive sending the S&P 500 to record high, while disappointing earnings reports pushed the Dow slightly lower. Early session pessimism that last night’s short-term agreement by Congress may only be delaying another fiscal showdown to early next year, was met with optimism that tapering of the Fed’s asset purchase program may be pushed out.

Meanwhile, Treasuries were higher in the wake of the deal agreement on Capitol Hill, while weekly jobless claims came in above expectations and regional manufacturing activity decelerated by a smaller rate than forecasted.

With the third quarter earnings season heating up, the Dow Jones Industrial Average was victimized by disappointing results with IBM and Goldman Sachs missing the Street’s revenue forecasts, and UnitedHealth issuing disappointing guidance, which offset stronger-than-expected quarterly results from Verizon Communications and American Express.

Moreover, eBay delivered softer-than-expected quarterly guidance for the crucial holiday shopping season. Shares of IBM weighed on the technology sector (-0.2%) while financials (+0.9%) were able to shake off Goldman’s weakness with help from American Express.

Thanks to Verizon’s strength, the telecom services sector (+1.9%) ended in the lead while other countercyclical groups-consumer staples (+1.0%), health care (+0.9%), and utilities (+1.6%)-also outperformed the broader market.

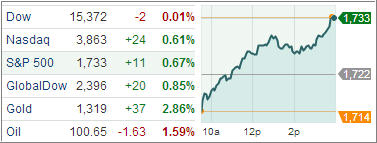

Elsewhere, the energy sector added 0.2% despite a 1.6% drop in crude oil. Among other commodities, gold futures jumped 2.8% to $1,318.60 per troy ounce. Part of the surge in gold could be attributed to significant greenback weakness. The Dollar Index ended near its lowest level of the year as global investors perceived the Congressional deal to extend the debt ceiling as a temporary fix, rather than a solution to an issue that is sure to re-emerge in the first months of 2014. In addition, the need to revisit the debt ceiling battle in a few months means the Federal Reserve will be less likely to taper its asset purchases during the early months of next year.

On the economic front, weekly initial jobless claims declined to 358,000 last week, above the 335,000 level that economists had expected. However, the four-week moving average, considered a smoother look at the trend in claims, rose to 336,500, while continuing claims dropped to south of the forecast of economists. The data continued to be impacted by the technical issues in California.

Our Trend Tracking Indexes (TTIs) joined the party and closed higher with the Domestic TTI ending the day at +4.14% while the International TTI closed +7.80% above its long-term trend line.

Contact Ulli