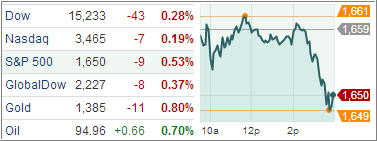

After trading in a narrow range through out the day, US index ETFs finished lower as investors turned negative following lackluster economic data and mixed earnings reports. Today snapped a string of record-high closes. The Dow Jones Industrial Average (DJIA) depreciated 42 points (0.3%) to 15,233, the S&P 500 Index was 8 points (0.5%) lower at 1,650, and the Nasdaq Composite fell by 6 points (0.2%) to 3,465. Wal-Mart lost 2.2 percent after the world’s largest retailer forecast second-quarter profit that was less than analysts estimated as the slow U.S. economy and higher taxes put pressure on consumers.

In a day full of economic news, initial claims for unemployment insurance jumped 32,000 last week, the most since November 2012, to 360,000, and above the consensus of 330,000. The Labor Department said that these figures were not impacted significantly by sequester-related furlough or other special factors. The four-week average of claims increased 1,250 to 339,250, but is still near its lowest level since January 2008, as the downward trend in firings remains intact.

Housing starts dropped 16.5% in April to 853,000 units at an annual rate, below the consensus of a 6.4% decline to 970,000 units. On the other hand, building permits, a sign of future construction activity, surged 14.3%, the second most on record, to a 1.017 million unit annual rate. The rate was above a million for the first time since June 2008. Economists expected a smaller 2.5% gain to 930,000 units. On a y/y basis both starts and permits continue to post double-digit gains.

Elsewhere, the Philly Fed General Business Conditions Index fell 6.5 points in May, its fourth decline in the past five months, to -5.2, indicating regional factory activity contracted. The consensus was for a small uptick to 2.0. Most individual indexes pointed to contraction.

Manufacturers were more upbeat about the six-month outlook than last month, as the Future Activity Index rose 12.8 points to 32.3. The Consumer Price Index (CPI) fell 0.4% in April, the most since December 2008, and more than the consensus of -0.3%. The recent decline in commodity prices in general has contributed to softer consumer prices. Import prices, PPI, and CPI all indicate less inflation.

Oversea, Japan’s 1Q GDP expansion came in at 0.9% quarter-over-quarter, boosted by consumer spending and export growth amid the yen’s sell-off to 4 ½ year lows, topping the 0.7% increase that economists had expected. Japan is allegedly a relative bright spot globally and, while the focus has been on the effect of the BoJ actions on the yen, we may be entering a second phase for stocks, driven by benefits for the real economy and corporate profits.

In the end, the indexes could not handle the onslaught of negative news. Give the advances of the recent past, the pullback was minor. Our Trend Tracking Indexes (TTIs) came off their lofty levels as well with the Domestic TTI ending the day at +4.99% while the International TTI settled at +10.13%.

For the latest charts and momentum figures, please review the updated StatSheet, which I will post within a couple of hours.

Contact Ulli