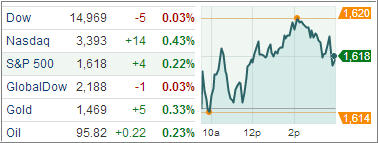

The Standard & Poor’s 500 Index extended its record level on Monday to kick-off the week. Stocks traded in a tight range and ended mixed but the Nasdaq outperformed again, thanks to another strong showing from Apple.

During the session, the S&P 500 also reached an all-time intraday high of 1,619.77. In moderate volume which came in about 13% lower than Friday’s levels, 612 million shares were traded on the NYSE, and 1.5 billion shares changed hands on the Nasdaq.

Financial stocks rallied the most out of 10 S&P 500 groups, as Bank of America Corp. climbed 5.2 percent. Cliffs Natural Resources Inc. added 5.5 percent after being raised to outperform from market perform by FBR Capital Markets. Humana Inc. (HUM) added 2.1 percent as its rating was boosted by JPMorgan Chase. Bank of America announced it would settle claims with MBIA for $1.6 billion, lifting shares of both companies.

Treasuries finished lower as there were no US economic reports scheduled for release today. This week’s U.S. economic calendar is expected to be light, with the headlining releases including: consumer credit, MBA Mortgage Applications, initial jobless claims, and wholesale inventories.

For that reason, the focus will likely be on international markets. The Bank of England, as well as the central banks of Australia, Norway and South Korea are set to meet, with the Bloomberg consensus expecting no change in policy for any of the banks. In China, following the softer-than-forecasted data on leading indicators and services sector activity, CPI, PPI, and trade data are expected to be released, but available credit will likely garner the most attention.

Our Trend Tracking Indexes (TTIs) changed only slightly from Friday’s close with the Domestic TTI now sporting a position of +4.26% while the International TTI reached +8.43%.

Contact Ulli