The market was able to overcome early losses, and closed the trading day higher, supported by China posting a wider-than-projected trade surplus and an unexpected rise in industrial production out of Germany.

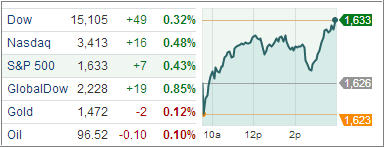

Both the Dow and S&P posted new closing highs. The gains came a day after the Dow closed above 15,000 for the first time ever. On the equity front, Dow member Walt Disney reported fiscal 2Q earnings of $0.79 per share, two cents above the consensus estimate, as revenues rose 10% year-over-year to $10.6 billion, compared to the $10.5 billion that forecasted. Fellow Dow component McDonald’s was traded lower in the wake of its mixed April sales report.

Due to lack of significant domestic economic data, stocks were driven by news from overseas. The market moved higher in the wake of a stronger-than-expected trade report from China, which eased concerns about a slowdown for the world’s second-largest economy.

Chinese exports imports grew more than expected in April, as exports rose 14.7% year-over-year, compared to the 9.2% increase that economists had expected, while imports jumped 16.8%, above the 13.0% increase that was anticipated. However, skepticism remained over the strength of real demand and the accuracy of the figures. German industrial production also rose more than forecast, increasing for a second month in March in a further sign that Europe’s largest economy is returning to growth.

As you know, U.S. stocks are in the fifth year of a bull market amid three rounds of bond purchases by the Federal Reserve. About 86 percent of S&P 500 stocks traded above their average prices from the past 50 days as of yesterday, the highest level since Feb. 13, according to Bloomberg.

Now that the Dow has cracked 15,000, the argument for “sell in May and go away” may be getting weaker. The gains have been fueled by massive amounts of money having been thrown at the market by the Fed, creating higher demand while constricting supply. What about earnings? About 72 percent of companies that have released results since the start of the earnings season have exceeded profit projections, while 52 percent have missed sales estimates.

The major trend remains up as our Trend Tracking Indexes (TTIs) are confirming. The Domestic TTI closed at +4.85% while its international cousin ended the day at +10.05%.

Contact Ulli