Equity markets celebrated yet another record date as the European Central Bank (ECB) cut its key interest rate, domestic jobless claims unexpectedly fell to a five year low, and the technology sector reported strong earnings.

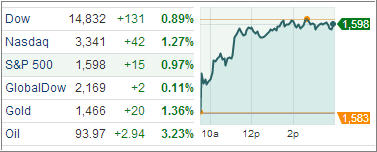

The Dow Jones Industrial Average was up 130 points (0.9%) to 14,830, the S&P 500 Index added 15 points (0.9%) to 1,597, sending it to another record high and erasing yesterday’s loss. The Nasdaq Composite gained 42 points (1.3%) to 3,341.

The most welcoming news of the day came from Europe as the ECB cut interest rates for the first time in 10 months and held out the possibility of further action if necessary to boost the euro zone economy. ECB policy makers meeting in Bratislava lowered the main refinancing rate to 0.5 percent from 0.75 percent. The interest rate cut fueled positive sentiment. The move follows Wednesday’s Federal Reserve action to continue its bond buying scheme to keep interest rates low and spur growth.

Investors also welcomed news that weekly jobless claims fell unexpectedly ahead of Friday’s employment report. Initial claims for unemployment insurance dropped 18,000 last week, its third decline in the past four weeks, to 324,000, the lowest level since January 2008.

Applications are a proxy for layoffs. When they fall below 350,000, it is generally consistent with moderate hiring. But layoffs are only half the equation: Companies also need to be confident enough to add workers for job growth to pick up and lower the unemployment rate.

Heading into the announcement tomorrow, economists forecasted that 160,000 new jobs were added in April. That would be a much better number compared to the dismal result in March; but below last year’s pace of nearly 185,000 per month. The unemployment rate is expected to remain unchanged at 7.6 percent.

The bull market has entered its fifth year as the S&P 500 surged 136 percent from a 12-year low in 2009, driven by better-than-expected corporate earnings and three rounds of bond purchases by the Federal Reserve. How long until we see a big pull-back?

Much of it depends on when/if the Fed determines that’s it’s time to slow down the money printing orgy. I think they won’t be able to for quite some time since that fact would pull the markets from their lofty levels in a hurry. Remember, the NY Fed last December noted that, without the various stimulus efforts, the S&P 500 would be hovering in the 700 range and not nibbling at 1,600.

Our Trend Tracking Indexes (TTIs) followed the indexes higher with the Domestic TTI reaching +4.20% while the International TTI rallied to +8.24%.

For the latest charts and momentum figures please review the updated StatSheet, which I will post within a couple of hours.

Contact Ulli